The world of blockchain technology has seen remarkable innovations over the years, with various platforms striving to enhance scalability, security, and versatility. One such groundbreaking entrant into the blockchain arena is Sui. In this article, we will delve into the fascinating world of Sui, a cutting-edge blockchain built on the Move programming language, operating on a Delegated Proof-of-Stake (DPoS) layer 1 framework. We will explore the core features of Sui and its native utility token, SUI, which offers versatile applications within the ecosystem.

What is SUI?

Sui, a cutting-edge blockchain built on the Move programming language, operates on a Delegated Proof-of-Stake (DPoS) layer 1 framework. At its core is the native utility token, SUI, offering versatile applications within the ecosystem.

Current SUI Use Cases:

- Network Fees: SUI facilitates seamless transaction fee payments on the network.

- Validator Staking: Holders can delegate their SUI holdings to validators, crucial for transaction processing and execution on the Sui platform.

- Native Liquidity: SUI ensures on-chain applications deployed on the Sui blockchain have access to native asset liquidity.

- Governance: Holding SUI provides a stake in the future governance decisions of the ecosystem.

Key components of the Protocol:

- Sui Move Programming Language: Sui utilizes Move, originally developed at Facebook for the Libra (later Diem) project. It’s tailored for smart contract creation within Sui, aligning with an object-centric data model.

- Parallel Transaction Processing: Sui optimizes transaction execution efficiency through parallel data models and execution engines.

- Horizontal Scaling: Network capacity grows in proportion to the increase in Sui validator’s processing power, ensuring low gas fees even during peak network usage.

- Object-centric Data Model: Sui processes and executes transactions using a causal-ordering approach, enabling parallel processing for fully independent objects.

- Consensus Mechanism: Transactions are grouped by objects, allowing validators to process transactions in parallel, enhancing scalability and facilitating parallel transaction submission and execution on a large scale.

- Complex Transactions (Shared Objects): For intricate transactions, Sui leverages the Narwhal and Bullshark protocol, incorporating a DAG-based mempool and efficient Byzantine Fault Tolerant (BFT) consensus.

- Simple Transactions (Non-Shared Objects): Basic transactions, involving non-shared objects, do not necessitate sequencing through Narwhal and Bullshark.

How Does Sui Work?

Sui vs Other Blockchains

Sui’s key features

- Massively Parallel Execution Enabled by Causal Order vs. Total Order Sui achieves extensive parallel execution through the distinction between causal order and total order in transaction processing.

- Composable Objects/NFTs with Sui’s Move Variant and Object-Centric Data Model Sui’s unique adaptation of Move and its focus on object-centric data models allow the creation of composable objects and NFTs within the blockchain.

- Improved Developer Experience with Blockchain-Oriented Move Programming Language Sui employs the blockchain-oriented Move programming language to enhance the overall developer experience, simplifying the process of creating and managing applications on the platform.

Traditional Blockchains

In the traditional blockchain model, validators collaborate to construct a shared accumulator, a secure representation of the blockchain’s state. This representation, often called blocks, is continually added to over time. Blockchains with deterministic finality require validators to sequence their proposals when adding new blocks, enabling consensus on the current state, validating proposed additions, and forecasting the chain’s state post-addition.

This well-established method of maintaining a consistent state has seen success for around 14 years, drawing from extensive research in Byzantine Fault Tolerant distributed systems dating back 50 years. However, it operates in a sequential manner, akin to adding pearls to a string. Consequently, this approach temporarily halts transaction flow, typically held in a “mempool,” during block consideration.

Sui Blockchain

In many cases, transactions in Sui don’t rely heavily on each other because they deal with separate parts of the system. For instance, someone might just want to send an asset to another person, and to check if this is allowed, we only need to look at the sender’s address. Sui simplifies this process by focusing on locking or pausing just the specific data needed, like the sender’s address, rather than stopping the entire chain. This way, the sender, who can only send one transaction at a time, is not slowed down by unrelated activities happening on the blockchain.

Sui extends this concept to more complex transactions where various elements under the sender’s control are involved. It uses a smart model and the strong ownership structure of Sui Move. By making the dependencies clear, Sui allows different parts of a transaction to be validated independently, ensuring smooth progress without interference from unrelated transactions.

However, it’s important to note that Sui still manages transactions that affect shared system components, but this isn’t the primary focus. Detailed insights into how Sui handles these situations can be found in the Narwhal (ensuring the availability of data submitted to consensus) and Bullshark (agreeing on a specific ordering of this data) consensus engine, as outlined in the State-of-the-art consensus section.

Transaction Confirmation in Sui

Sui takes a different approach to confirming transactions, prioritizing speed. Each transaction is confirmed individually, ensuring swift validation and providing a proof of its permanence on the Sui network.

Here’s a glimpse into how it works:

- The sender shares the transaction with all Sui validators.

- Validators individually vote on the transaction.

- Each validator’s vote carries a specific weight based on their Proof of Stake rules.

- The sender collects a majority of these votes, forming a certificate, and shares it with all validators.

- Validators execute the transaction and sign the results.

- Finality is achieved when the client receives a majority of signed results, assuring the transaction’s validity and persistence.

- Optionally, the sender can create a certificate summarizing the transaction’s effects.

Though it involves a bit more effort from the sender, following these steps efficiently leads to a quick cryptographic proof of transaction finality, offering a seamless and secure process. Additionally, the transaction’s security doesn’t rely on the sender’s private keys, allowing for potential third-party involvement in transaction management.

Sui Transactions

Transaction metadata

Sui transactions include essential information:

- Sender Address: The user’s address initiating the transaction.

- Gas Input: A reference to the object covering transaction costs, owned by the user in Sui’s native currency (SUI).

- Gas Price: The number of native tokens per gas unit to be paid, always nonzero.

- Maximum Gas Budget: The max gas units that can be used for the transaction. If exceeded, the transaction aborts, only deducting gas input value.

- Epoch: The Sui epoch this transaction targets.

- Type: The transaction type – call, publish, or native – along with specific data.

- Authenticator: A cryptographic signature on encoded data and the public key linked to the sender’s address.

- Expiration: An optional deadline for transaction validity, enhancing control over execution timing. Default is no deadline.

Transaction flow

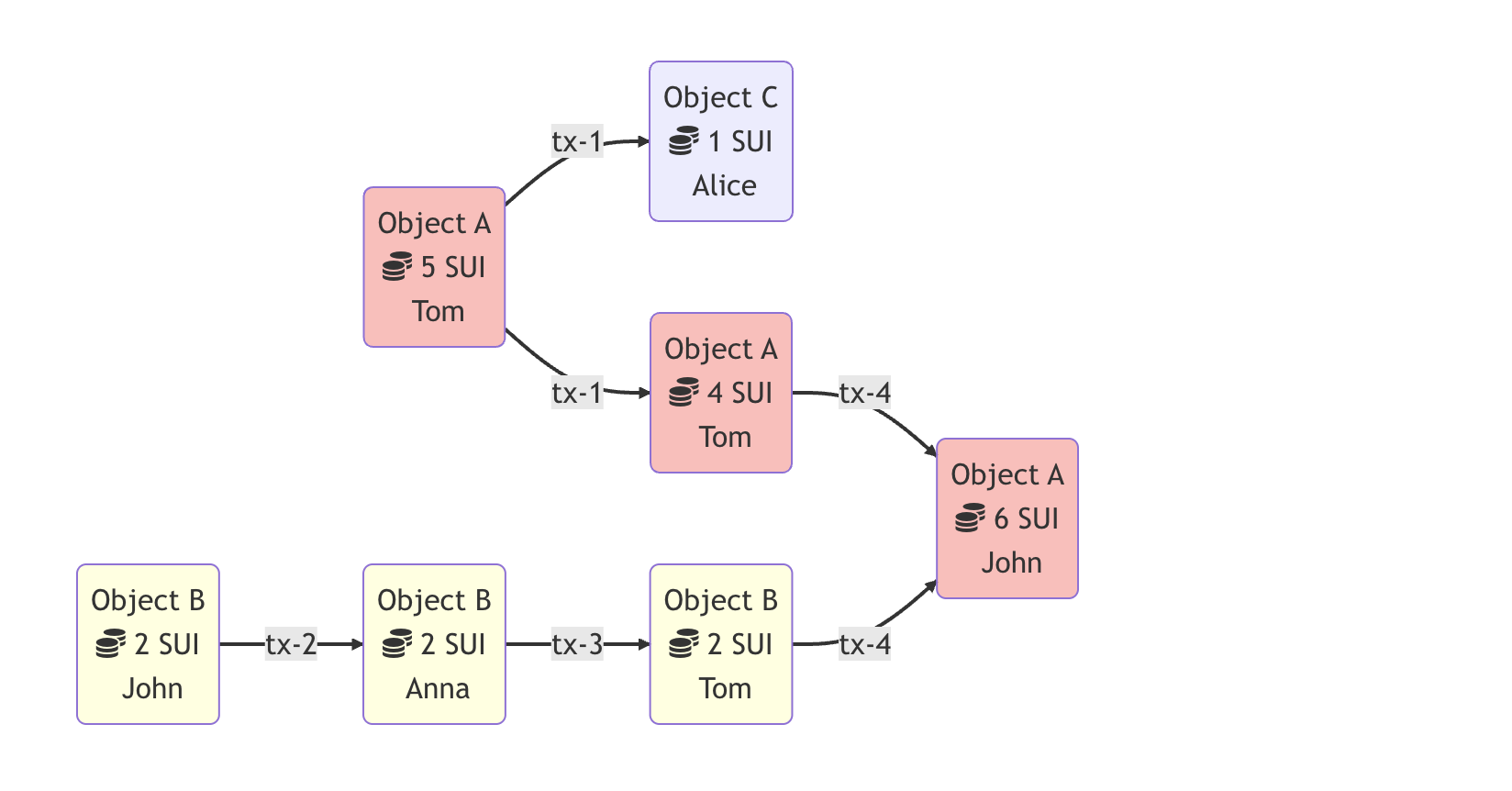

Let’s illustrate the relationship between objects and transactions in Sui through an example involving two objects and multiple transactions:

- Initial State:

- Object A: 5 SUI coins (Owner: Tom)

- Object B: 2 SUI coins (Owner: John)

- Transaction 1 (Tom to Alice):

- Input: Object A (5 SUI)

- Output:

- Object A: 4 SUI (still owned by Tom)

- Object C: 1 SUI (now owned by Alice)

- Transaction 2 (John to Anna):

- Input: Object B (2 SUI)

- Output: Object B’s ownership changes to Anna

- Transaction 3 (Anna to Tom):

- Input: Anna’s transaction (2 SUI)

- Output: Tom now has 6 SUI coins (4 from Object A, 2 from Object B)

- Transaction 4 (Tom to John):

- Input: Object A and Object B (6 SUI)

- Output: Object A with a value of 6 SUI (Object B destroyed, its value added to Object A)

Sui Validators

The Sui network is managed by independent validators, each using Sui software on their machines. Validators handle client requests, focusing on write requests. Sui employs Delegated Proof-of-Stake (DPoS) to select and empower network validators based on their voting power. Validators are motivated to act honestly through transaction fee shares, staking rewards, and penalties for misbehavior.

Epochs and Quorums in Sui

The Sui network operates in fixed-duration epochs, usually around 24 hours. Each epoch has a set of validators with specific voting power. Reconfiguration can happen at epoch boundaries, starting a new Sui protocol instance with the prior epoch’s final state as the beginning and the updated validator set.

Quorums, vital for Byzantine fault tolerance, are groups of validators whose combined voting power exceeds 2/3 of the total. This ensures secure transaction commitment. Validators only commit a transaction if accompanied by cryptographic signatures from a quorum, forming a certificate. This approach guarantees agreement on committed certificates and their effects when over 2/3 validators adhere to the protocol.

Write Requests Handling

A validator processes two types of write requests: transactions and certificates. Clients communicate a transaction to a quorum to gather necessary signatures, forming a certificate. This certificate is then submitted to a validator for committing state changes on that validator.

Consensus Engine

Narwhal and Bullshark, developed by Mysten Labs, serve as Sui’s high-throughput mempool and consensus engines. Narwhal manages data availability for consensus, while Bullshark orchestrates the specific ordering of this data.

The Sui Consensus Engine, an evolution of decades of multi-proposer consensus research, achieves exceptional throughputs of over 125,000 transactions per second with a mere two-second latency for a 50-party deployment. This includes robust security measures, permanent storage, and an efficiently scaled primary-worker architecture.

The Sui Consensus Engine brings immense scalability benefits to:

- Blockchains with issues of runaway latencies due to larger blocks.

- Blockchains with rapid execution (e.g., transaction-focused or UTXO data model), but where mempool and consensus struggle to keep pace.

Tokenomics

Sui economy

In the Sui economy, there are three main participant groups:

- Users: They interact with the Sui platform, creating, modifying, and transferring digital assets, and engaging with advanced applications through smart contracts, interoperability, and composability.

- SUI Token Holders: They can stake their tokens to validators, participate in proof-of-stake, and exercise governance rights within the Sui platform.

- Validators: They oversee transaction processing and execution on the Sui platform.

The core components of the Sui economy encompass:

- SUI Token: The native asset of the Sui platform.

- Gas Fees: Charges applied to all network activities, rewarding proof-of-stake participants, and deterring spam and denial-of-service attacks.

- Sui’s Storage Fund: Allocated to redistribute stake rewards over time and compensate future validators for storing past on-chain data.

- Proof-of-Stake Mechanism: Utilized for selecting, motivating, and rewarding honest behavior by Sui Validators and staked SUI owners.

- On-chain Voting: Employed for governance and protocol enhancements.

Token

Token Name and Supply

- The native token is called SUI, distinct from the Sui platform.

- Total supply capped at 10,000,000,000 tokens.

Token Utility

- Staking for proof-of-stake engagement.

- Gas fee payment for transactions and operations.

- Versatile asset for various applications and functionalities.

- Governance participation through on-chain voting.

Economic Dynamics

- Finite supply encourages efficient token usage.

- Storage fund impacts circulating SUI based on on-chain data needs.

Token allocation

| Token Name | SUI |

|---|---|

| Community Access Program | 5.88% of the total token supply |

| Binance Launchpool | 0.40% of the total token supply |

| Investors | 14.00% of the total token supply |

| Mysten Labs Treasury | 10.00% of the total token supply |

| Early Contributors | 20.00% of the total token supply |

| Sui Foundation | 49.73% of the total token supply |

Token release schedule

The remaining Sui Foundation (~36.28%) tokens will continue to vest beyond May 2030. As for the remaining Mysten Labs Treasury (~8.68%) and Early Contributors (~0.88%) tokens, the distribution has not been decided.

Delegated Proof-of-Stake System

Token Staking

- Validator Structure:

- In each epoch, a set of validators process operations.

- Validator’s stake from SUI token holders decides their voting power for transactions.

- Staking SUI:

- SUI staking involves locking tokens for the entire epoch.

- Token Flexibility:

- SUI holders can freely withdraw or switch validators with each epoch transition.

Sui Incentives Simplified

Sui’s economic model gives users a vital role in monitoring. Users want fast transactions, so they prioritize responsive validators. These efficient validators get higher rewards. SUI stakers share these rewards or penalties with their chosen validator. An unresponsive validator faces double consequences: direct reward reduction and users shifting stakes to better-performing validators.

Key Highlight

- Permissionless: Sui is a Layer 1 blockchain that allows creators and developers to build for the next billion web3 users without restrictions.

- Horizontally Scalable: Sui’s design supports diverse application development rapidly and cost-effectively, leveraging multiple machines per validator for increased performance.

- Causal Ordering: Enhances scalability by enabling parallel agreement on independent transactions, facilitating efficient parallel processing.

- Frontier Tokenomics: Sui’s tokenomics align with its optimized design, ensuring low and stable transaction fees even as the chain scales horizontally and manages substantial on-chain data.

- No System Timeouts: Sui operates at network speed without waiting for system timeouts, reducing latency significantly compared to traditional blockchains.

- Low Latency: Transaction latency is minimized, especially for common actions like payments and transfers, by keeping it directly related to transaction contention.

- Asset-Oriented Data Model: Sui supports secure and composable programmability through its asset-oriented data structure.

- Safe Programmable Objects: Strongly typed objects with runtime-level access control and bytecode-level integrity verification ensure a secure programming environment.

- On-the-Fly Composability: Programmable Transaction Blocks allow developers to dynamically create complex sequences of transactions tailored to their applications without publishing new smart contract code.

- Sponsored Transactions: Streamlines asset management by enabling a gasless user experience, reducing friction for users.

Roadmap, updates, and business development

Completed Milestones

| Completion Date | Milestone | Commentary |

|---|---|---|

| 2022: Q2 | Devnet launch | Medium |

| 2022: Q4 | Incentivized Testnet Wave 1: Network | Blog |

| 2023: Q1 | Incentivized Testnet Wave 2: Tokenomics | Blog, Tokenomics, Frenemies Game |

| 2023: Q2 | Permanent Testnet | Blog |

| 2023: Q2 | Mainnet | Tweet |

Updated roadmap

Q2 2023:

- Mainnet launch.

- ZK Login.

Q3 / Q4 2023:

- State Snapshot.

- Archival Node.

- Light Client & Sparse Node.

- Intra-validator scaling and sharding.

- Optimizations across signature verification, networking storage, indexing.

- Sui Move developer experience: prover, improved language server, linting, auto-formatting, repl/language shell, debugger.

- MEV prevention, congestion pricing.

- Short vs long-term storage pricing, storage economics for archival nodes.

Commercial partnerships and business development progress

- The Sui Foundation Partners with BitGo for Digital Asset Management: The Sui Foundation chose BitGo as custodian of the SUI tokens it maintains as its community reserve.

- DeepBook to Serve as a Foundational Liquidity Layer on Sui: DeepBook, a decentralized limit order book, will allow builders to easily create DeFi apps.

- The Sui Foundation Announces Bug Bounty Program with Immunefi: Incentivize white hat hackers to report issues, helping maintain a secure and stable platform while rewarding responsible disclosure, via Immunefi dashboard.

- Sui Demo Day in Hong Kong: $50K of prizes were awarded to 16 teams across four tracks: (1) NFT & Gaming, (2) Infrastructure & Dev Tooling, (3) DID, Governance, & Social, and (4) DeFi & Payments.

- Sui Foundation Awards Over $400,000 to Developers in Grant Program: Grants to developers of projects that benefit the Sui ecosystem.

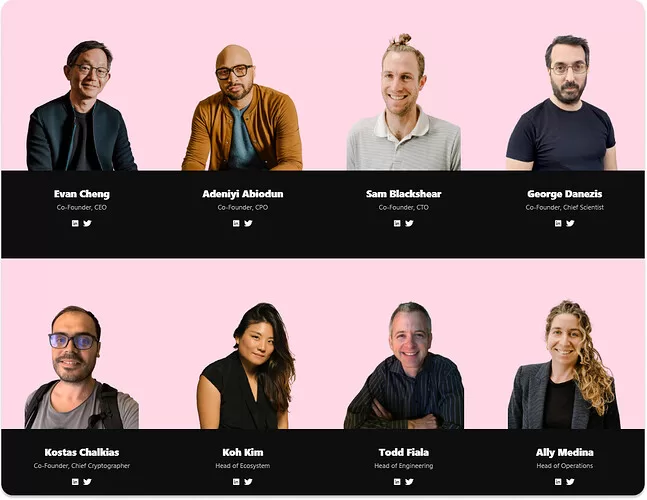

SUI Team

Prior to the creation of Mysten Labs / Sui, all co-founders worked together at Novi:

- Evan Cheng, CEO: former Head of Research and Development at Novi and Technical Director of Meta.

Previously, he worked at Apple for 10 years. - Sam Blackshear, CTO: Former Chief Engineer at Novi, specializing in the Move programming language.

- Adeniyi Abiodun, CPO: Former Head of Product Development at Novi, Meta*. Previously worked at VMware, Oracle, PeerNova, HSBC, JP Morgan;

- Danezis, Chief Scientist: Former researcher at Novi, Meta*. Previously worked at Chainspace, Microsoft;

- Kostas (Konstantinos) Chalkias: Former leading cryptographer at Novi. Previously worked at R3, Erybo, Safemarket, NewCrypt.

It seems that the Mysten Labs team has managed to attract more useful Meta* human capital. The continuity and maturity of the team is always an attractive factor for any startup, which benefits Mysten Labs.

Conclusion

In conclusion, Sui represents a pioneering stride in the realm of Layer 1 blockchains, focusing on enabling innovation and catering to the burgeoning audience of web3. Its emphasis on scalability, low latency, and an asset-oriented data model showcases a commitment to efficiency and adaptability. Sui not only paves the way for developers but also embraces users by offering a seamless and gasless experience, embodying the spirit of permissionless innovation in the blockchain space. With its innovative features and dedication to user-friendly interaction, Sui holds promise for shaping the future landscape of decentralized applications and the broader blockchain ecosystem.

* Use the SUI tag to read information related to the project on Coinbold