Ultrade is unveiling cutting-edge Native Exchanges (NEX) technology, combined with Whitelabel SaaS infrastructure and a sustainably scalable B2B2C business model. Ultrade solves critical challenges faced by crypto traders and numerous tokenized projects across the market.

Incubated by Decubate

Link

- Website: https://ultrade.org/

- Testnet App: https://testnet.ultrade.org/

- X (Twitter): https://twitter.com/ULTRADE_org

- Pitch Deck: Here

- Tokenomisc: Here

Industry Problem:

Despite the booming cryptocurrency market, billions of dollars are lost annually by traders and projects, primarily due to the extractive practices of CEXs & DEXs.

Projects aiming to list on CEXs face significant financial hurdles, including hefty “marketing” listing fees, which often result in token dumping. Additionally, the cost to list can reach up to $2 million, and projects are required to redirect their users to third-party exchanges, leading to decreased user retention and increased friction.

On the other hand, projects listing on DEXs encounter various challenges such as MEV attacks targeting project investors, initial liquidity sniping, and poor cross-chain user experience.

Traders operating on CEXs face issues such as hidden frontrunning by the exchanges, and relinquishing custody over assets, exposing them to risks of fraud and theft. Similarly, traders on DEXs are susceptible to MEV attacks, sniping new listings, and bear high trading fees and gas costs, further exacerbating the financial strain.

This vicious cycle of value extraction perpetuates the challenges faced by market participants, hindering the growth and stability of the cryptocurrency ecosystem.

Ultrade’s Solution

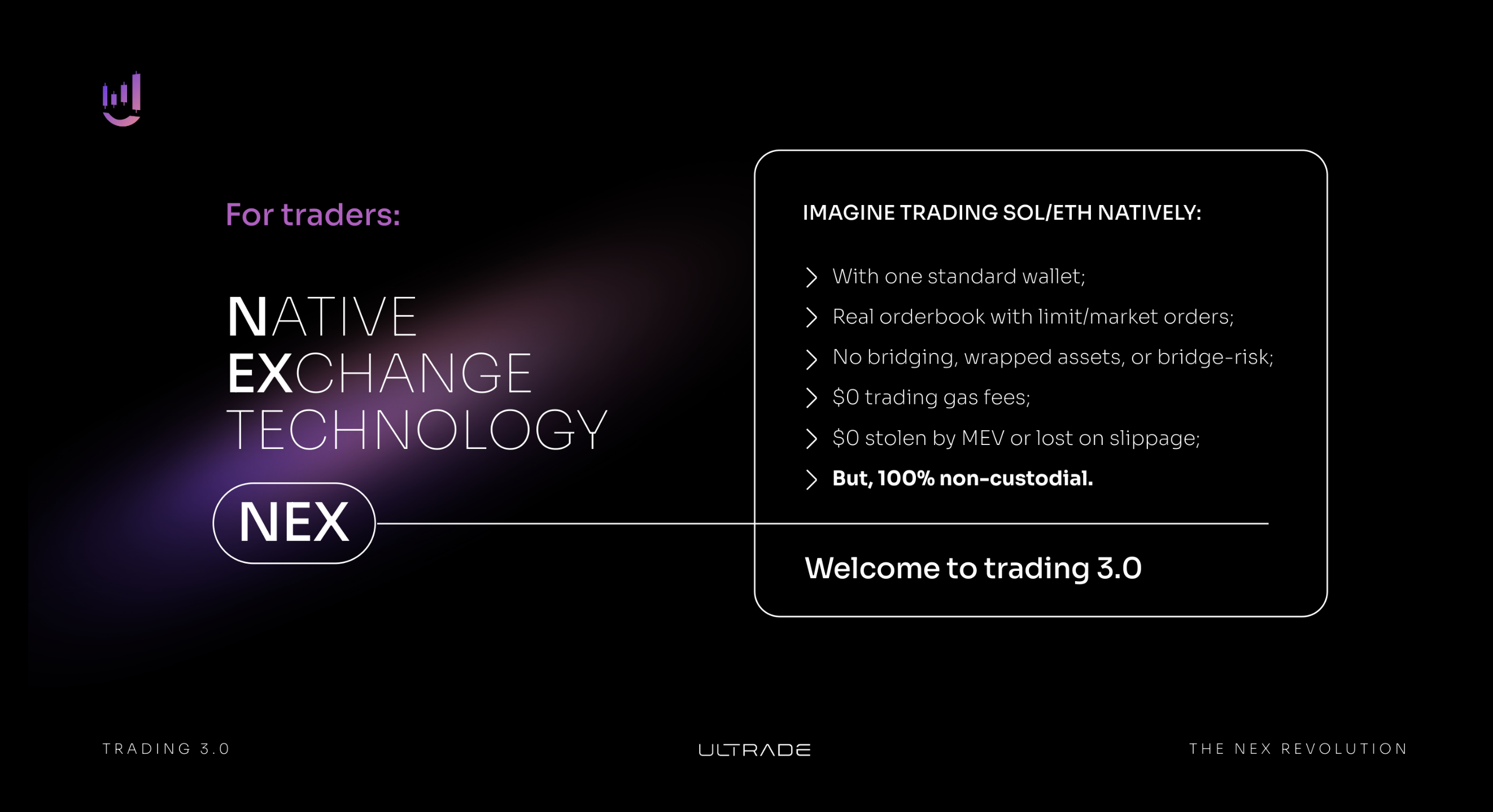

Introducing a revolutionary trading technology called Native Exchanges (NEX) that surpasses the limitations of both CEXs and DEXs, offering enhanced benefits for traders while empowering projects with ownership and control. Ultrade’s innovative solution is developed as a white label infrastructure, providing projects with the ability to launch and brand their NEX within just 10 minutes, without requiring any development expertise or incurring costs.

Now for the first time ever, projects can set their own trading fees and unlock a new revenue stream while maintaining autonomy over their exchange operations. They can self-list their tokens for trading and enjoy co-listings from other partners, thereby maximizing exposure and liquidity through network effects.

Key Ultrade Experience Features

Gasless trading experience, Real order book with limit & market orders, No bridging, wrapped assets, or bridge-risk, Zero value stolen by MEV or lost on slippage & [Pipeline] Enhanced Trading Tools: Spot, Perpertual Swaps & 5x Margin.

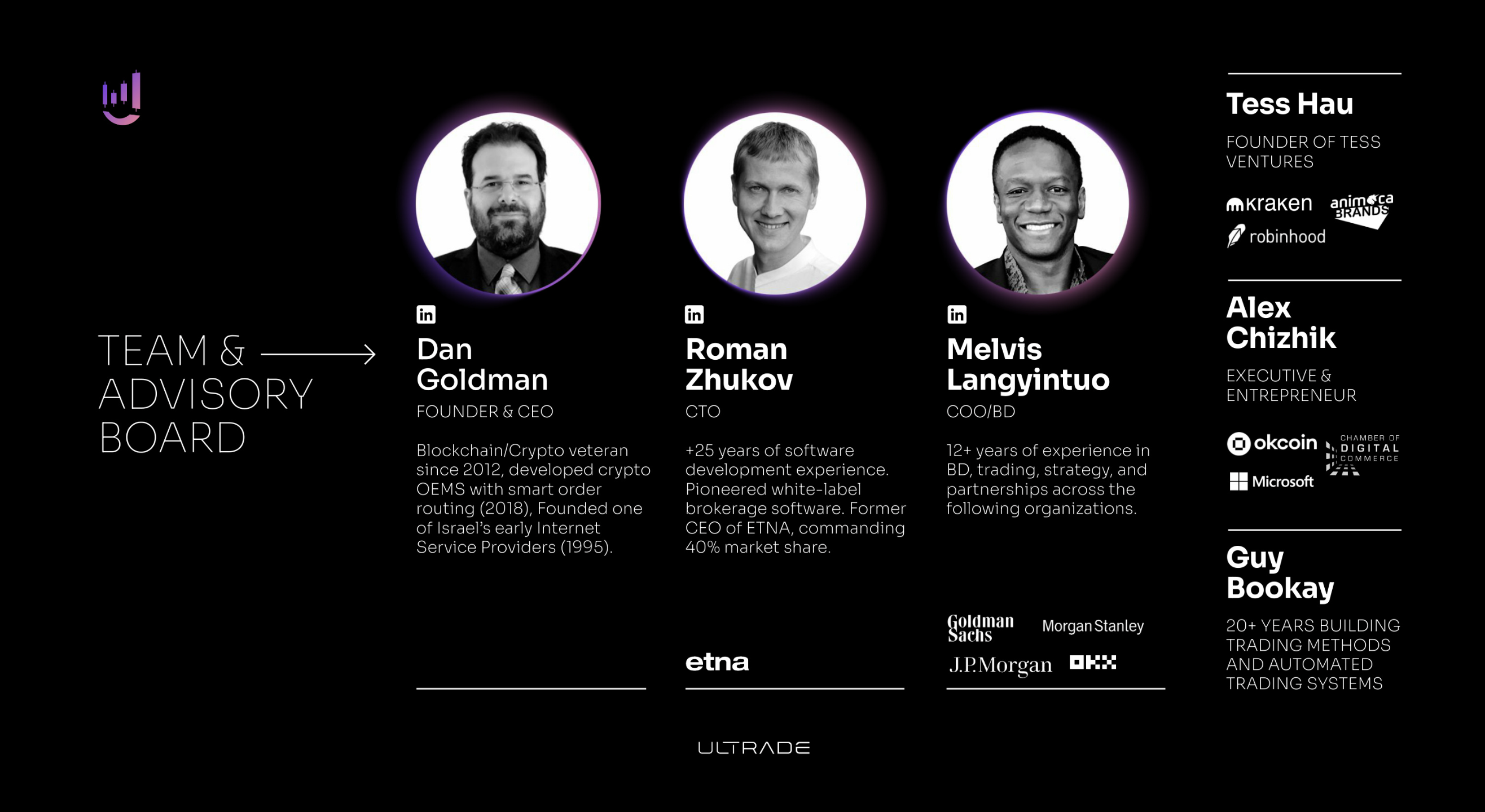

The Core Team & Advisors shaping Ultrade’s future

- Dan Goldman, CEO & Founder: Blockchain / Crypto veteran since 2012. Founded among the first Israeli internet service providers, created Isracoin, a not-for-profit country coin that reached the top-10 CMC (pre-Ethereum). Built institutional crypto OEMS with smart order routing.

- Roman Zhukov, CTO: 25+ years of software development experience. Pioneered white-label brokerage software. Former CEO of ETNA, commanding 40% market share. Expert in capital markets technology and financial services.

- Melvis Langyintuo, COO & Business Development: 12+ years of experience in BD, trading, strategy, and partnerships across OKX, Goldman Sachs, JP Morgan & Morgan Stanley.

- Tess Hau, CEO & Founder of Tess Ventures: Portfolio includes industry-leading companies such as Kraken, Robinhood, Animoca Brands & many more.

- Alex Chizhik, Global Head of Listing OkCoin: Executive and entrepreneur, working with OKCOIN, Microsoft & Chamber of Digital Commerce.

- Guy Bookay, Advisor: Developing high-end market-making trading methods and automated trading systems. Guy is responsible for billions in trading volumes annually.

- Elliot Hagemeijer, CEO & Founder of Decubate: Successfully advised 50+ Web3 startups in listing & GTM strategy, including names such as ChainGPT, Sidus Heroes, AI Tech & more.

Private Sale Allocation

- FDV: $35M

- Price: $0.007

- TGE: 5%

- Terms: 3M Cliff / 14M Vesting