In the rapidly changing landscape of cryptocurrencies, there’s a term that has garnered significant interest from both investors and enthusiasts: Bitcoin ETF. In the midst of the cryptocurrency craze, particularly the soaring popularity of Bitcoin, the potential arrival of Exchange-Traded Funds (ETFs) centered around digital assets has the potential to completely transform the investment landscape.

Welcome to our comprehensive guide, where we will delve into the intriguing realm of Bitcoin ETFs. In this report, we will explore the potential of these investment vehicles, examine the approval process they undergo, and analyze the potential impact of spot Bitcoin ETF approval on the crypto market. Stay tuned for an in-depth analysis of this exciting development.

Table of Contents

Why Bitcoin ETFs Matter: A Brief Overview

Bitcoin exchange-traded funds ( Bitcoin ETFs) are financial instruments that enable investors to obtain exposure to Bitcoin without the necessity of directly possessing or safeguarding the digital currency. These Exchange-Traded Funds (ETFs) operate similarly to conventional stock market ETFs, rendering them an appealing choice for both institutional and retail investors seeking to access the possibilities of cryptocurrencies without having to navigate the intricacies of digital wallets and exchanges.

The approval of Bitcoin ETFs has been eagerly anticipated by investors for various reasons. To begin with, these funds present a streamlined and regulated avenue for investing in cryptocurrencies, thereby offering a degree of security and credibility that may be absent within the cryptocurrency market.

Moreover, the introduction of Bitcoin exchange-traded funds (ETFs) has the potential to attract a substantial influx of fresh investment into the market, resulting in increased demand and subsequently driving up the price of Bitcoin. The potential consequences of this ripple effect may have far-reaching implications for other cryptocurrencies, ultimately leading to a significant transformation of the overall digital assets ecosystem.

What Exactly is a Bitcoin ETF?

Prior to exploring the approval process and potential ramifications, it is imperative to comprehend the nature of a Bitcoin exchange-traded fund (ETF). A Bitcoin Exchange-Traded Fund (ETF) is specifically structured to mirror the value of Bitcoin, enabling investors to acquire shares that symbolize ownership in the digital currency.

The utilization of an indirect strategy for investing in Bitcoin is attractive to individuals who desire to gain exposure to the digital asset while avoiding the intricacies involved in securely storing and managing it.

How Does the Approval Process Work?

There are many regulatory barriers that must be overcome in order for a Bitcoin Exchange-Traded Fund (ETF) to be approved. These funds can be approved by the Securities and Exchange Commission (SEC), a well-known regulatory body in the United States. Proposals are subjected to a rigorous review process by the Securities and Exchange Commission (SEC) in order to determine whether or not they comply with existing regulations. The primary focus of this process is to protect investors’ interests and preserve market integrity. Applications for Bitcoin ETFs must demonstrate strong security measures, transparency, and compliance with legal requirements. This makes the approval process one of the most demanding and time-consuming for applicants.

The Bitcoin ETF approval process is a laborious and drawn-out procedure. This is a quick synopsis of the procedure:

- ETF applicants must file a registration statement with the SEC. The registration statement must include detailed information about the ETF, such as its investment strategy, its risks, and its fees.

- The SEC reviews the registration statement to determine whether it is complete and accurate. The SEC may also ask the ETF applicant for additional information.

- If the SEC finds the registration statement to be complete and accurate, it will publish a notice in the Federal Register. The notice will give the public an opportunity to comment on the ETF proposal.

- After the public comment period has ended, the SEC will decide whether to approve or disapprove the ETF proposal. If the SEC approves the ETF, it will publish an order approving the ETF’s registration statement.

In evaluating Bitcoin ETF proposals, the SEC took consideration of several factors, such as:

- The custody of Bitcoin: The SEC wants to ensure that Bitcoin ETFs have robust security measures in place to protect investors’ Bitcoin assets.

- Market surveillance: The SEC wants to ensure that Bitcoin ETFs are traded in a fair and orderly manner.

- Investor protection: The SEC wants to ensure that Bitcoin ETFs are suitable for investors and that investors understand the risks involved in investing in Bitcoin ETFs.

A Bitcoin ETF has not yet received SEC approval. That being said, the SEC has been debating proposals for Bitcoin ETFs for a number of years, so it’s feasible that one will be approved soon.

The following are some of the factors contributing to the protracted and challenging SEC approval process for Bitcoin ETFs:

- Bitcoin is a new and volatile asset. The SEC is concerned about the risks of investing in Bitcoin, and it wants to make sure that Bitcoin ETFs are adequately structured to protect investors.

- The Bitcoin market is relatively unregulated. The SEC wants to make sure that Bitcoin ETFs are traded in a fair and orderly manner.

- There is a lack of precedent for Bitcoin ETFs. There are no other ETFs that invest directly in Bitcoin. This means that the SEC has to carefully consider the implications of approving a Bitcoin ETF before it does so.

Notwithstanding the difficulties, there are several grounds for optimism that the SEC will soon approve a Bitcoin ETF. To start, the SEC appears to be nearing a decision after reviewing Bitcoin ETF proposals for a number of years. Second, the Bitcoin market is developing into a more regulated and mature space. The third reason is that investors’ desire for Bitcoin ETFs is rising.

The Bitcoin industry would reach a significant milestone if the SEC approved a Bitcoin ETF. As an asset class, it might help to legitimize Bitcoin by making it more accessible to investors. Also, there would probably be a big spike in investments in the Bitcoin market as a result.

BlackRock and the Bitcoin ETF Revolution

BlackRock is the world’s largest asset manager, with over $10 trillion in assets under management. If BlackRock launches a Bitcoin ETF, it would be a major signal of legitimacy for Bitcoin and would likely attract significant investment from institutional investors.

The introduction of a Bitcoin ETF by BlackRock could have several benefits:

- It would increase the accessibility of Bitcoin to institutional investors. Many institutional investors are currently hesitant to invest in Bitcoin directly due to regulatory concerns and the lack of a regulated investment vehicle. A BlackRock Bitcoin ETF would provide institutional investors with a way to invest in Bitcoin in a regulated and familiar manner.

- It would increase the liquidity of the Bitcoin market. A BlackRock Bitcoin ETF would attract significant investment, which would increase the depth of the Bitcoin market and make it easier for investors to buy and sell Bitcoin.

- It would give Bitcoin a seal of approval from a major financial institution. BlackRock is one of the most respected financial institutions in the world. If BlackRock launches a Bitcoin ETF, it would send a strong signal that Bitcoin is a legitimate asset class.

Of course, there are additional possible dangers connected to BlackRock’s Bitcoin ETF launch:

- It could increase the volatility of Bitcoin prices. A large influx of investment from institutional investors could lead to sharp increases in Bitcoin prices. However, it could also lead to sharp declines in Bitcoin prices if institutional investors decide to sell their Bitcoin holdings.

- It could give BlackRock too much control over the Bitcoin market. If BlackRock becomes a major player in the Bitcoin market, it could potentially have a significant impact on Bitcoin prices and could potentially manipulate the market.

All things considered, BlackRock’s possible entry into the cryptocurrency space through Bitcoin ETFs is an important development. It is crucial to be aware of the possible risks as well as the potential benefits that could be present for the Bitcoin market.

Notably, BlackRock has not yet made any announcements regarding the launch of a Bitcoin ETF. The business has stated that it is keeping an eye on the regulatory environment and is open to the idea.

To get the most recent news from Blackrock, use the tag blackrock.

Estimating inflows into Bitcoin ETFs

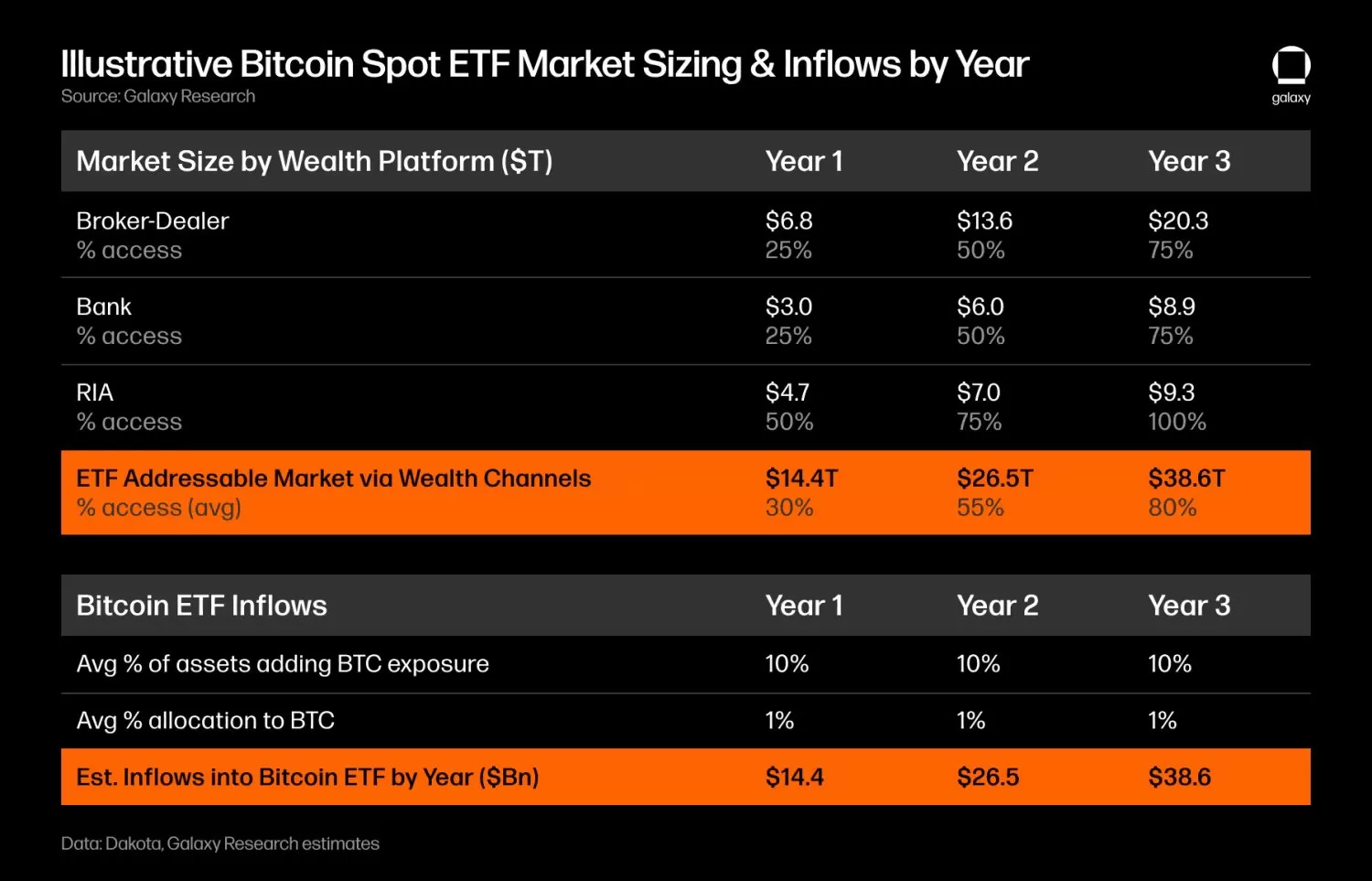

In a groundbreaking report released by Galaxy Digital, a prominent cryptocurrency investment firm, it has been projected that Bitcoin Exchange-Traded Funds (ETFs) may experience a staggering influx of $14.4 billion within the initial year of their trading.

This eye-opening estimation has sent shockwaves through the financial world as the potential impact of Bitcoin ETFs continues to captivate investors and industry experts alike.

This is based on the following assumptions:

- Bitcoin ETFs would attract a mix of institutional and retail investors.

- Institutional investors would account for 60% of the inflows, while retail investors would account for 40% of the inflows.

- Institutional investors would invest an average of $50 million in Bitcoin ETFs, while retail investors would invest an average of $5,000 in Bitcoin ETFs.

The report also notes that the actual amount of inflows could be higher or lower than $14.4 billion, depending on a number of factors, such as the overall market conditions, the regulatory environment, and the performance of Bitcoin.

In the world of digital currencies, Bitcoin ETFs are poised to become a magnet for substantial capital influx. Let’s delve into the factors driving this anticipated surge:

- Bitcoin ETFs would offer a regulated and familiar way to invest in Bitcoin. This would make Bitcoin more accessible to institutional investors and retail investors who are hesitant to invest in Bitcoin directly.

- Bitcoin ETFs would provide exposure to Bitcoin without the need to own Bitcoin directly. This would eliminate some of the risks associated with investing in Bitcoin, such as the risk of hacking and the risk of losing private keys.

- Bitcoin ETFs would increase the liquidity of the Bitcoin market. This would make it easier for investors to buy and sell Bitcoin, and it would also help to reduce the volatility of Bitcoin prices.

Overall, the approval of Bitcoin ETFs is expected to be a major positive development for the Bitcoin market. Bitcoin ETFs could attract significant inflows from institutional and retail investors, which could help to drive up the price of Bitcoin and increase the adoption of Bitcoin.

Impact of Spot Bitcoin ETF Approval on the Crypto Market

Bitcoin exchange-traded funds (ETFs) have the potential to significantly impact investors, which presents a significant opportunity for change. Investment funds provide a practical way for investors to diversify their portfolios and expose themselves to the potentially lucrative but highly volatile cryptocurrency market. In addition, the possibility of launching Bitcoin exchange-traded funds (ETFs) could draw in a sizable number of prospective investors who had previously expressed reluctance because of the complexity of cryptocurrency trading.

The following are some potential effects that Bitcoin ETFs may have on cryptocurrency investors:

- Increase accessibility: Bitcoin ETFs would make it easier for investors to invest in Bitcoin. Investors would be able to buy and sell Bitcoin ETFs on traditional stock exchanges, just like any other stock or ETF. This would make Bitcoin more accessible to institutional investors and retail investors who are hesitant to invest in Bitcoin directly.

- Reduce risk: Bitcoin ETFs would provide investors with a way to invest in Bitcoin without the need to own Bitcoin directly. This would eliminate some of the risks associated with investing in Bitcoin, such as the risk of hacking and the risk of losing private keys.

- Increase liquidity: Bitcoin ETFs would increase the liquidity of the Bitcoin market. This would make it easier for investors to buy and sell Bitcoin, and it would also help to reduce the volatility of Bitcoin prices.

- Attract new investors: Bitcoin ETFs could attract a new wave of investors to the cryptocurrency market. Investors who are hesitant to invest in Bitcoin directly due to its complexity or its volatility may be more likely to invest in Bitcoin through an ETF.

All things considered, Bitcoin ETFs have the ability to lower risk, boost liquidity, draw in new investors, and increase accessibility to Bitcoin. The cryptocurrency market and investors may benefit greatly from this.

Here are a few particular instances of how Bitcoin ETFs might help cryptocurrency investors:

- A retail investor who is interested in investing in Bitcoin could simply buy shares of a Bitcoin ETF on their brokerage account. They would not need to worry about setting up a cryptocurrency wallet or learning how to trade on a cryptocurrency exchange.

- An institutional investor could invest in a Bitcoin ETF as part of its asset allocation strategy. This would allow the institutional investor to gain exposure to Bitcoin without having to directly manage Bitcoin.

- A trader could use Bitcoin ETFs to hedge their other cryptocurrency holdings or to speculate on the price of Bitcoin.

Although they are still in the early phases of development, Bitcoin ETFs have the power to completely change how investors make Bitcoin investments.

Conclusion: Navigating the Future of Crypto Investments

In summary, the prospective authorization of Bitcoin exchange-traded funds (ETFs) signifies a noteworthy landmark in the progression of the digital currency market. The implementation of these regulated investment vehicles has the potential to facilitate widespread access to cryptocurrencies, thereby fostering inclusivity among investors and potentially causing significant transformations in the global financial arena. Despite the existence of ongoing challenges, the increasing sense of optimism surrounding Bitcoin exchange-traded funds (ETFs) indicates a fundamental shift in our perception and engagement with digital assets.

Key Takeaways:

- Bitcoin ETFs provide a simplified and regulated way to invest in cryptocurrencies.

- The approval process involves rigorous scrutiny by regulatory bodies such as the SEC.

- BlackRock’s potential involvement could catalyze widespread adoption of Bitcoin ETFs.

- Bitcoin ETFs offer investors a convenient and secure method to diversify their portfolios.

- The future of crypto investments looks promising, with Bitcoin ETFs at the forefront of this financial revolution.

FAQs

What is Spot Bitcoin ETF?

A spot Bitcoin ETF is an exchange-traded fund that tracks the price of Bitcoin in the spot market. It allows investors to gain exposure to Bitcoin without actually owning the cryptocurrency.

How could the approval of a spot Bitcoin ETF impact the crypto market?

The approval of a spot Bitcoin ETF could have a significant impact on the crypto market. It would provide a regulated and easy way for institutional and retail investors to gain exposure to Bitcoin without actually owning it. This could lead to a surge in demand for Bitcoin, driving up its price. Additionally, the increased inflow of capital into the crypto market through the ETF could boost liquidity and market activity.

What are the potential benefits of a spot Bitcoin ETF approval?

The approval of a spot Bitcoin ETF could bring several benefits to the crypto market. It would provide a regulated investment vehicle for investors to access Bitcoin, potentially attracting more mainstream investors to the market. This increased investor participation could lead to greater overall market stability and increased liquidity. It would also provide a price-tracking mechanism for Bitcoin, helping to establish it as a legitimate and recognized asset class.

Could a spot Bitcoin ETF approval lead to increased Bitcoin exposure?

Yes, a spot Bitcoin ETF approval could lead to increased exposure to Bitcoin. As investors gain access to Bitcoin through the ETF, more capital would flow into the cryptocurrency market. This could result in a higher demand for Bitcoin and potentially drive up its price. Investors who may have been hesitant or unable to invest directly in Bitcoin may find it more accessible through the ETF, leading to increased exposure for the cryptocurrency.

How would the approval of a spot Bitcoin ETF impact other cryptocurrencies?

The approval of a spot Bitcoin ETF could have a positive spillover effect on other cryptocurrencies. As the ETF brings more capital and attention to the overall crypto market, it could create a more favorable environment for other cryptocurrencies as well. Increased investor interest and liquidity in the market could extend beyond Bitcoin and benefit other digital assets.

Are there any risks associated with a spot Bitcoin ETF approval?

Yes, there are risks associated with a spot Bitcoin ETF approval. One of the main concerns is the potential for increased market volatility. As more investors enter the market through the ETF, it could lead to greater price swings and heightened volatility. Additionally, any adverse regulatory actions or negative news regarding Bitcoin could also impact the ETF and its

In the rapidly changing landscape of cryptocurrencies, there’s a term that has garnered significant interest from both investors and enthusiasts: Bitcoin ETF. In the midst of the cryptocurrency craze, particularly the soaring popularity of Bitcoin, the potential arrival of Exchange-Traded Funds (ETFs) centered around digital assets has the potential to completely transform the investment landscape. Welcome to our comprehensive guide where we will delve into the intriguing realm of Bitcoin ETFs. In this report, we will explore the potential of these investment vehicles, examine the approval process they undergo, and analyze the potential impact they could have on the cryptocurrency market. Stay tuned for an in-depth analysis of this exciting development.