Introduction: Decoding the Enigma of Bitcoin Halving

In the realm of cryptocurrency, the term “Bitcoin halving” resonates as a pivotal event, significantly impacting both the market and investors’ sentiments. Every four years, the cryptocurrency community eagerly awaits this event, akin to a financial milestone, as it fundamentally alters the dynamics of Bitcoin’s supply and demand. In this comprehensive exploration, we delve into the nuances of Bitcoin halving, deciphering its significance, historical implications, and the anticipated impact of the upcoming fourth halving in April 2024.

Understanding Bitcoin Halving: A Strategic Economic Move

Bitcoin halving, a programmed event ingrained within the very fabric of the Bitcoin network, stands as a testament to Satoshi Nakamoto’s ingenious design. This strategic move ensures the controlled issuance of new bitcoins, maintaining scarcity and preventing inflation. Unlike traditional fiat currencies vulnerable to government interventions, Bitcoin’s finite supply, capped at 21 million coins, fosters an environment where demand governs its value.

The Economics Behind Bitcoin Halving

Bitcoin’s limited supply mirrors precious commodities like gold and diamonds, amplifying its allure as a store of value. Investors, drawn to the promise of scarcity, continually drive demand, thereby enhancing Bitcoin’s market value. This scarcity factor positions Bitcoin as a hedge against government monetary policies, countering the detrimental effects of inflation.

The Impact of Bitcoin Halving: A Market Catalyst

Mining Dynamics Post-Halving

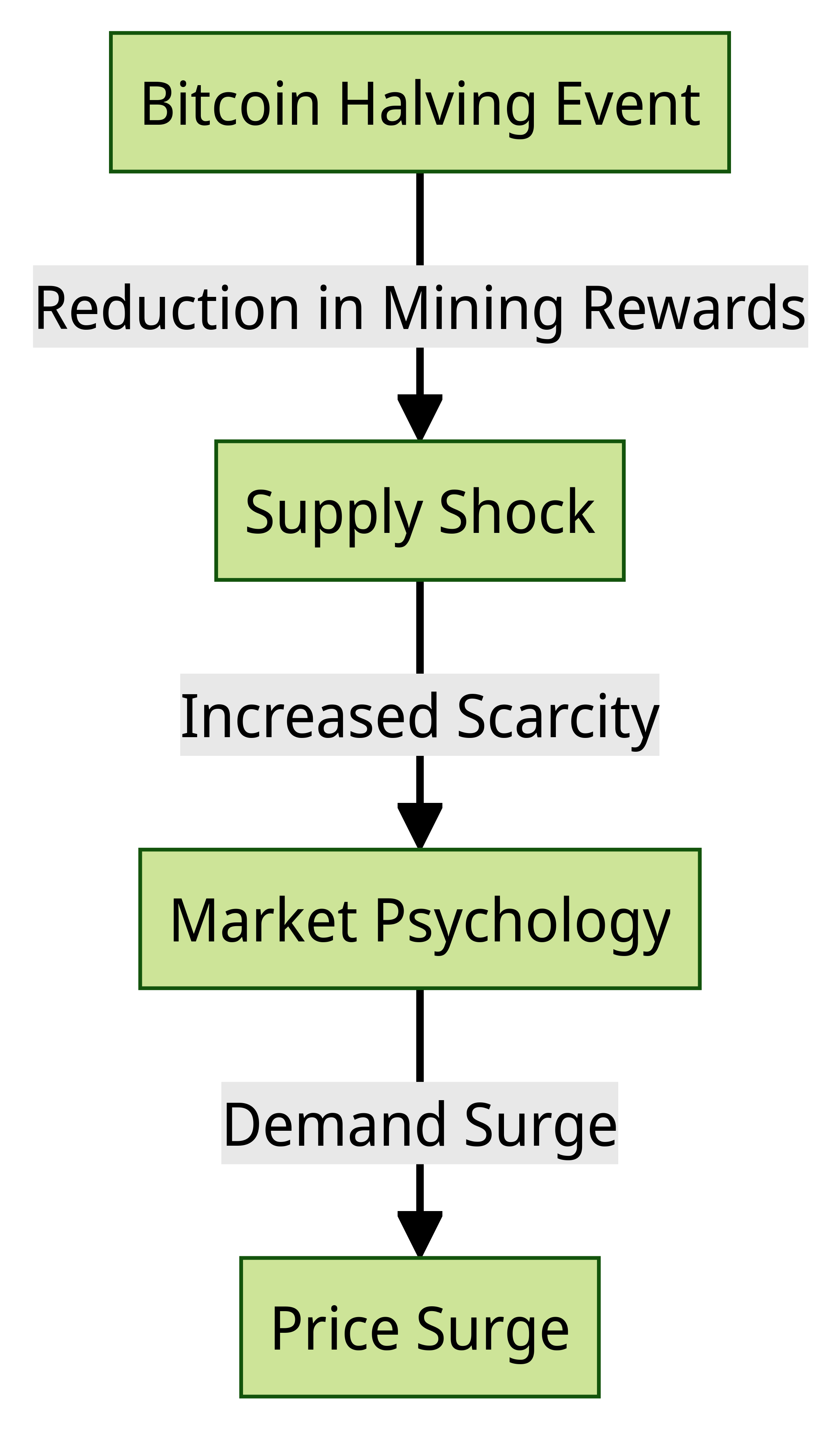

At the heart of Bitcoin’s operation lies the intricate process of mining, wherein miners validate transactions and secure the network. Bitcoin halving slashes the miner rewards by half, creating a supply shock. This reduction, exemplified in the forthcoming shift from 6.25 BTC to 3.125 BTC per block, amplifies the scarcity effect, compelling market participants to recognize Bitcoin’s digital rarity.

Market Psychology and Demand Surge

Bitcoin halving orchestrates a symphony of market psychology and demand surge. The deflationary narrative associated with this event acts as a beacon, drawing in investors and enthusiasts alike. As history attests, these demand-driven phenomena contribute to a substantial increase in Bitcoin’s value, albeit with a time lag following the halving event. The undeniable allure of potential profits fuels this demand, creating a cyclical pattern of increased interest post-halving.

Historical Perspective: Tracing Bitcoin Halving’s Impact

A Glimpse into the Past Halving Cycles

First Halving (November 2012)

- Rewards Halved: 50 to 25 BTC

- Price at Halving: $12

- Subsequent Year Peak: $1,152

Second Halving (July 2016)

- Rewards Halved: 25 to 12.5 BTC

- Price at Halving: $650

- Subsequent Year Peak: $19,118

Third Halving (May 2020)

- Rewards Halved: 12.5 to 6.25 BTC

- Price at Halving: $8,500

- Subsequent Year Peak: $67,549

Looking Ahead: Anticipating the Fourth Halving in April 2024

The imminent arrival of the fourth Bitcoin halving in April 2024 ripples with anticipation and speculation. Historical patterns, coupled with the core economic principles governing Bitcoin, hint at a potential surge in value post-halving. Market analysts echo the sentiment that past performance often rhymes with future trends, underlining the resilience and consistent growth observed in Bitcoin’s value across previous halving cycles.

Mining in the Post-Halving Era: Balancing Act of Efficiency and Rewards

While halving events curtail miner rewards, the crypto-mining landscape continues to evolve. Technological advancements yield more efficient mining processes, mitigating potential losses. The perpetual increase in Bitcoin’s value, catalyzed by halving, aligns with the ongoing advancements, ensuring mining remains a financially viable endeavor for enthusiasts and businesses alike.

Conclusion: Bitcoin Halving

In the intricate tapestry of cryptocurrency economics, Bitcoin halving emerges as a pivotal thread, weaving together scarcity, demand dynamics, and investor sentiment. As we stand on the precipice of the fourth halving in April 2024, the historical precedents and economic principles affirm the enduring value of Bitcoin. A beacon of financial innovation, Bitcoin halving continues to shape the crypto landscape, captivating investors and enthusiasts, fueling a relentless pursuit of decentralized digital wealth.