A U.S.-based blockchain firm, Securitize, renowned for its expertise in real-world asset tokenization, takes a significant leap as it launches operations in Europe.

Empowering Traditional Finance with Tokenization

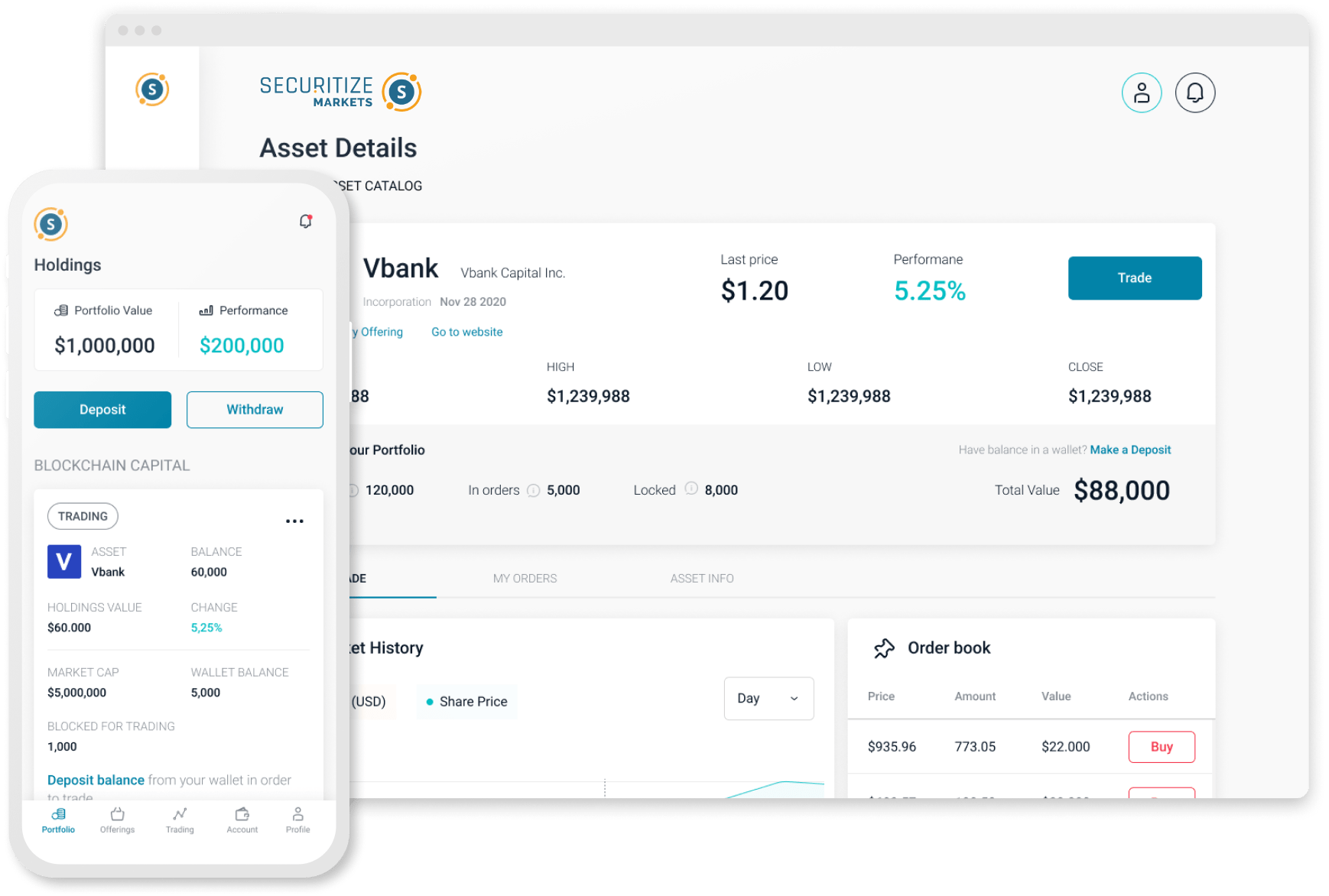

Securitize’s strategic move to Europe opens new horizons for financial markets, as tokenization facilitates the seamless conversion of traditional assets such as stocks and bonds into blockchain-based tokens.

Pioneering the Way for European Businesses

Securitize co-founder Carlos Domingo emphasizes the firm’s pioneering position, becoming the first to issue and trade tokenized securities in both the U.S. and Europe. Leveraging the EU’s new pilot regime for digital assets, European businesses are set to benefit significantly from this innovative approach.

Unlocking Capital Opportunities

Through tokenization, European businesses gain novel avenues to raise capital via primary capital raises while accessing potential tax benefits and liquidity through secondary trading. This breakthrough offers a promising framework for financial growth and accessibility.

Embracing the Spanish Market

Securitize’s entrance into Spain’s real estate market signifies a pivotal step as tokens representing equity in the Spanish real estate investment trust, Mancipi Partners, take center stage.

Navigating the Regulatory Landscape

Securitize’s groundbreaking initiative receives official approval from the Spanish General Secretariat of the Treasury and International Finance, enabling the deployment of digital asset securities under supervised “sandbox” conditions. This innovative approach provides invaluable real-world trials before securing the necessary licenses.

Expanding Boundaries with the European Union

Upon the expiration of the sandbox period, Securitize is poised to advance its operations within the European Union Pilot Regime. With plans to issue, manage, and trade tokenized securities not just in Spain but throughout the EU, Securitize’s vision for global accessibility takes shape.

A Pioneering Blockchain Solution

Securitize leverages the Avalanche blockchain to tokenize shares, opening the path to secondary trading, expected to commence in September. This cutting-edge blockchain solution signifies a transformative approach to financial accessibility and liquidity.

Accelerating Investor Exposure

In collaboration with asset management firm Hamilton Lane, Securitize aims to bolster investor exposure to tokenized securities, paving the way for greater investor inclusivity and diversification.

A New Chapter for Tokenization

Securitize’s foray into Europe’s financial landscape marks a monumental chapter in the evolution of tokenization. With its expertise, Securitize fosters a future where traditional and blockchain-based assets converge, unlocking unprecedented opportunities for businesses and investors alike. The expansion into the European market signifies a resolute commitment to advancing financial accessibility and innovation on a global scale. As tokenization continues to redefine finance, Securitize remains at the forefront, pioneering the way for a more inclusive and efficient financial ecosystem.