Cryptocurrency lending company Voyager Digital, after facing withdrawal suspension and filing for bankruptcy under Chapter 11, has witnessed a significant net outflow of over $250 million since it reinstated withdrawals on June 23. This article will delve into the current state of Voyager Digital and its efforts to recover from bankruptcy while providing valuable insights into the company’s financials and assets.

Introduction

In recent times, Voyager Digital, a prominent cryptocurrency lending company, has been grappling with financial challenges that led to the suspension of withdrawals and the eventual filing for bankruptcy under Chapter 11. However, after resuming withdrawals, the company has experienced a significant outflow of funds.

Net Outflow and Withdrawal Resumption

Since Voyager Digital reinstated withdrawals on June 23, the company has witnessed a net outflow exceeding $250 million. This suggests that customers have been withdrawing their funds from the platform, potentially due to concerns surrounding the company’s financial stability.

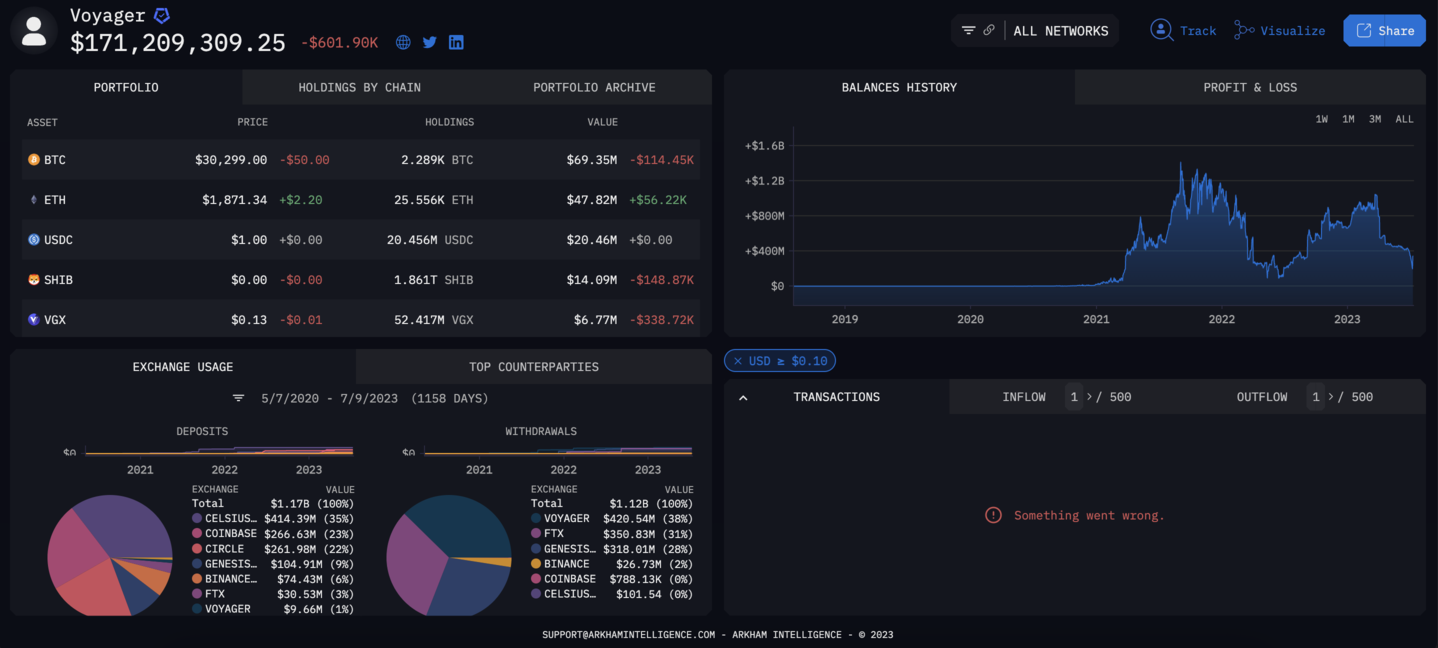

Voyager Digital’s Cryptocurrency Holdings

According to the findings from Arkham, Voyager Digital currently holds a cryptocurrency value of $171.2 million. The platform’s Clean Asset Ratio, excluding its native token VGX, stands impressively at 96.15%. Some notable assets held by Voyager Digital include 2,289 BTC, 25,556 ETH, 20.456M USDC, 1.861T trillion SHIB, and 3.35M MATIC.

Liquidation Plan Approval

Voyager Digital’s liquidation plan received approval from U.S. Bankruptcy Judge Michael Wiles in May. This approval allowed the crypto lending firm to distribute approximately $1.33 billion worth of crypto assets back to its customers, effectively marking the end of its Chapter 11 recognition endeavors.

Options for Customer Withdrawals

Customers were given two options for withdrawing their funds from Voyager. They could either choose to receive the amount as cryptocurrency through the Voyager app or wait for a 30-day period and withdraw it as cash. This flexibility provided customers with different choices based on their preferences and needs.

Recovery of Customer Funds

With the initial distribution of 35% of customers’ funds nearing completion, Voyager Digital will continue its efforts to retrieve additional assets for distribution among its creditors. This step is crucial in resolving outstanding debts owed to the company, such as the significant debt of nearly $665 million owed by Three Arrows Capital.

Efforts to Retrieve Additional Assets

In its quest to recover additional assets, Voyager Digital has made several attempts to sell its holdings. Unfortunately, these attempts have been unsuccessful so far. One such instance involved an intended sale of assets to FTX for $1.42 billion. However, the deal fell through when the SBF-led exchange experienced a well-known downfall in November.

Debt Owed by Three Arrows Capital

Three Arrows Capital, during its collapse, owed Voyager Digital approximately $665 million. This debt places Voyager in a challenging position, as the company strives to recover these funds through asset retrieval and subsequent distribution to creditors.

Failed Asset Sale Attempts

Despite its efforts, Voyager Digital’s attempts to sell its assets have encountered hurdles. The failed deal with FTX is one example of the challenges faced. These setbacks highlight the complexities involved in the cryptocurrency market and the need for companies like Voyager to navigate through them strategically.

Conclusion

Voyager Digital’s recent journey through withdrawal suspension, bankruptcy filing, and subsequent net outflow of funds has posed significant challenges for the company. However, with the resumption of withdrawals and the approval of its liquidation plan, Voyager is taking essential steps toward recovering and distributing assets to customers and creditors alike.

FAQs

Q1: How much money has Voyager Digital experienced in net outflow since reinstating withdrawals? Since reinstating withdrawals, Voyager Digital has witnessed a net outflow exceeding $250 million.

Q2: What is Voyager Digital’s Clean Asset Ratio? Voyager Digital’s Clean Asset Ratio, excluding its native token VGX, stands at an impressive 96.15%.

Q3: What are some of the notable assets held by Voyager Digital? Notable assets held by Voyager Digital include 2,287.4 BTC, 27,363 ETH, 18,558,3840 USDC, 2,060 trillion SHIB, and 3,60,000 MATIC.

Q4: What were the options provided to customers for withdrawing their funds from Voyager? Customers were given the choice to receive their funds as cryptocurrency through the Voyager app or wait for a 30-day period and withdraw it as cash.

Q5: How much debt did Three Arrows Capital owe Voyager Digital? During its collapse, Three Arrows Capital owed Voyager Digital approximately $665 million.