EigenLayer, a pioneering DeFi protocol, witnessed a significant 200% surge in its Total Value Locked (TVL) after raising its liquid staking limit to 100K Ether. This strategic decision not only spurs participation from users but also positions EigenLayer at the forefront of the booming decentralized finance (DeFi) domain.

EigenLayer Rides the Surge: 200% Spike in TVL

The DeFi landscape is abuzz with excitement as EigenLayer, a trailblazing restaking protocol, makes headlines with a staggering 200% surge in its Total Value Locked (TVL). This surge comes on the heels of a strategic move by EigenLayer to elevate its liquid staking limit to an impressive 100K Ether.

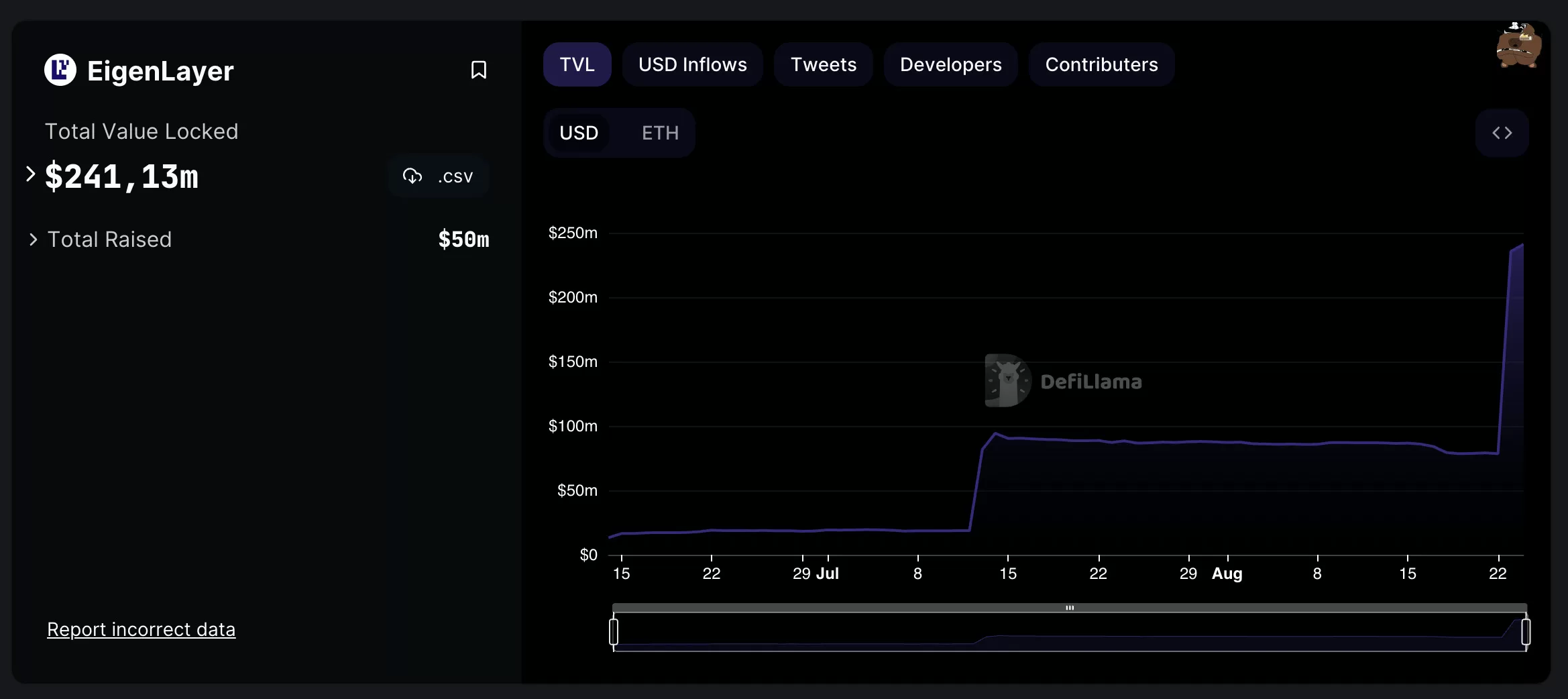

TVL Leaps from $78 Million to $236.7 Million

In a dramatic and sudden jump, EigenLayer’s TVL has soared from its previous position of approximately $78 million to an impressive $236.7 million. This notable ascent occurred mere hours after the announcement of its expanded liquid token staking limit, as reported by reliable data source DeFiLlama.

Innovative Token Cap: Gradual Increase Sparks User Participation

EigenLayer’s approach to enhancing user engagement is rooted in its incremental token cap expansion strategy. This approach encourages a gradual increase in user participation, ultimately leading to a more vibrant and dynamic ecosystem. Among the liquid tokens that users can deposit are notable options such as Lido’s stETH, Rocket Pool’s rETH, and Coinbase’s cbETH.

Unlocking Additional Yield Rewards with EigenLayer

EigenLayer’s distinct appeal lies in its capacity to enable users to restake their ETH liquid-staked assets, thereby unlocking an array of additional yield rewards. Launched in June 2023, EigenLayer’s innovative offering has swiftly gained traction for its ability to amplify the earning potential of DeFi participants.

Liquid Staking: DeFi’s Premier Primitive with a $18 Billion Market

Within the realm of decentralized finance (DeFi), liquid staking has solidified its position as a premier primitive, boasting an impressive market valuation of $18 billion. Lido, a prominent player in this domain, currently claims a substantial 74% dominance, underscoring the widespread influence of liquid staking within the DeFi landscape.

Shaping the Future of DeFi: EigenLayer’s Ascendancy

EigenLayer’s meteoric rise in TVL echoes its pivotal role in shaping the future of decentralized finance. By harnessing the power of increased liquid staking limits, EigenLayer not only drives heightened user engagement but also contributes to the overarching growth and evolution of the DeFi ecosystem.

In summary, EigenLayer’s exponential TVL surge following its strategic move to expand liquid staking limits highlights the dynamic nature of the DeFi sector and underscores the transformative potential of innovative protocols.