In recent years, the cryptocurrency market has witnessed a significant evolution, bringing forth innovative investment opportunities for both seasoned and novice investors. One such innovation is the introduction of spot Bitcoin exchange-traded funds (ETFs).

Unlike their futures-based counterparts, spot Bitcoin ETFs offer a unique investment vehicle, allowing ordinary investors to gain exposure to the price movements of Bitcoin within their regular brokerage accounts.

In this article, we will delve into the intricacies of spot Bitcoin ETFs, exploring how they work and elucidating the advantages they present to investors.

Table of Contents

What are Spot Bitcoin ETFs?

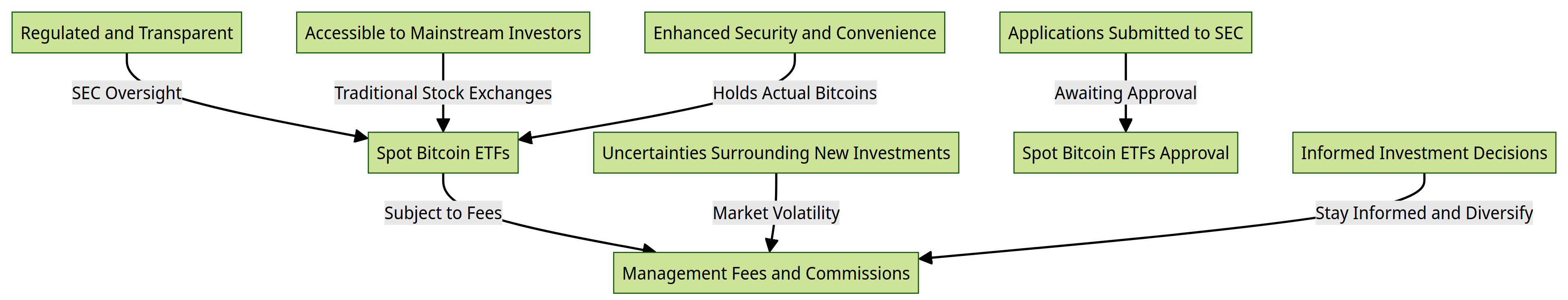

A spot Bitcoin ETF, or exchange-traded fund, is an investment vehicle that allows ordinary investors to gain exposure to the price movements of Bitcoin in their regular brokerage accounts. Unlike futures-based Bitcoin ETFs, a spot Bitcoin ETF invests directly in Bitcoin as the underlying asset, rather than derivatives contracts based on its price.

How Spot Bitcoin ETFs Operate

Spot Bitcoin ETFs operate on a simple yet robust mechanism that bridges the gap between the traditional financial market and the dynamic realm of cryptocurrencies.

Spot Bitcoin exchange-traded funds (ETFs) function by directly acquiring and retaining bitcoins as the fundamental asset. In contrast to futures-based Bitcoin exchange-traded funds (ETFs), spot Bitcoin ETFs possess direct ownership of bitcoins rather than relying on financial instruments such as futures contracts to replicate Bitcoin’s prices.

The following is an analysis of the operational mechanisms of spot Bitcoin exchange-traded funds (ETFs).

Direct Ownership

Bitcoin exchange-traded funds (ETFs) of the spot variety are designed to possess physical bitcoins as their underlying asset. This implies that each unit of the ETF represents a proportional quantity of bitcoins held within the ETF.

Price Tracking

The cost of a location The Bitcoin Exchange-Traded Fund (ETF) is specifically structured to closely mirror the price fluctuations of Bitcoin. The value of the ETF’s shares will correspondingly increase or decrease in response to the fluctuation of Bitcoin’s price.

Stock Exchange Trading

Spot Bitcoin exchange-traded funds (ETFs) are traded on conventional stock exchanges, such as the New York Stock Exchange (NYSE), as opposed to cryptocurrency exchanges. This feature facilitates the seamless purchase and sale of shares of the Exchange-Traded Fund (ETF) by investors via their respective brokerage accounts.

Accessibility

Spot Bitcoin ETFs offer a convenient avenue for investors to acquire exposure to Bitcoin without the necessity of directly possessing and overseeing cryptocurrencies. Traditional investors are afforded increased accessibility to the exchange-traded fund (ETF) as they are able to engage in the purchase and sale of its shares via their pre-existing brokerage accounts.

It is noteworthy to mention that, as of the present date ( November 1, 2023 ), there is an absence of spot Bitcoin exchange-traded funds (ETFs) accessible within the United States. Nevertheless, it is worth noting that spot Bitcoin exchange-traded funds (ETFs) are currently accessible in various nations such as Canada and Germany.

Advantages of Spot Bitcoin ETFs

Spot Bitcoin exchange-traded funds (ETFs) present numerous benefits for investors seeking to acquire exposure to Bitcoin without assuming direct ownership of the digital currency. The following are several notable benefits:

Accessibility

Spot Bitcoin exchange-traded funds (ETFs) offer a convenient and accessible avenue for a wider spectrum of investors to participate in the cryptocurrency market. Investors have the opportunity to acquire shares of the ETF via traditional brokerage accounts, thereby obviating the necessity of establishing and upholding a digital wallet or engaging with cryptocurrency exchanges.

Diversification

Investing in a spot Bitcoin exchange-traded fund (ETF) offers the opportunity to achieve diversification within the cryptocurrency market. Exchange-traded funds (ETFs) frequently opt to include a diversified assortment of Bitcoin rather than a singular unit, thereby facilitating the dispersion of investment risk. The act of diversifying one’s investment portfolio can prove advantageous for investors seeking to reduce the inherent volatility linked to Bitcoin.

Regulated Investment Structure

The observation or identification of a particular location or point in a given context. Bitcoin exchange-traded funds (ETFs) provide a regulated and widely recognized investment framework. These entities function within established financial markets and adhere to regulatory obligations. This feature offers investors a degree of transparency and investor safeguarding that might not be present in alternative cryptocurrency investment alternatives.

Liquidity

Spot Bitcoin exchange-traded funds (ETFs) afford investors the opportunity to gain exposure to liquid assets. These assets are subject to daily transactions, akin to other securities traded in the public market. The presence of liquidity enables investors to conveniently enter or exit their positions, thereby offering them flexibility and the potential to minimize transaction costs.

Lower Barriers to Entry

The introduction of Spot Bitcoin ETFs substantially reduces the obstacles associated with entering the cryptocurrency market. Cryptocurrency investment vehicles offer a viable option for investors who may exhibit reluctance to directly engage with Bitcoin or navigate the complexities of cryptocurrency exchanges. The enhanced accessibility has the potential to attract a larger number of institutional and retail investors to the cryptocurrency industry.

Benefits of Spot Bitcoin ETFs

Spot Bitcoin exchange-traded funds (ETFs) provide a range of advantages to investors seeking to acquire exposure to Bitcoin without assuming direct ownership of the digital currency. Outlined below are several significant advantages:

Regulated and Accessible Investment

Spot Bitcoin exchange-traded funds (ETFs) offer a regulated and convenient avenue for conventional investors to engage in Bitcoin investment. Rather than engaging in the process of navigating cryptocurrency exchanges and establishing digital wallets, investors have the option to purchase shares of a Bitcoin exchange-traded fund (ETF) using traditional brokerage accounts.

Convenience and Simplicity

The utilization of a Bitcoin exchange-traded fund (ETF) streamlines the investment procedure, particularly for individuals who are inexperienced or apprehensive about engaging in a Bitcoin transaction. The utilization of this method obviates the necessity of engaging with the intricacies associated with the direct acquisition and retention of Bitcoin.

Enhanced Market Liquidity

The potential implementation of a Bitcoin exchange-traded fund (ETF) has the capacity to enhance the market liquidity of Bitcoin. The increased involvement of investors via the Exchange-Traded Fund (ETF) has the potential to contribute to a more stable Bitcoin market and potentially mitigate abrupt price volatility.

Market Credibility

A spot Bitcoin ETF can further establish Bitcoin’s standing in the traditional financial world, drawing both institutional and retail investors. It reinforces Bitcoin’s credibility as an investment asset and may attract more mainstream adoption.

Transparent and Regulated Investment

Bitcoin exchange-traded funds (ETFs) fall within the regulatory scope of the Investment Company Act of 1940, thereby providing comprehensive safeguards for consumers. They offer a method that is direct, easily understood, and promotes a higher level of safety for prospective investors.

Diversification

The inclusion of a Bitcoin Exchange-Traded Fund (ETF) in an investment portfolio enables the attainment of diversification. Exchange-traded funds (ETFs) frequently maintain a collection of Bitcoin units rather than a solitary unit, thereby offering advantages in terms of diversification. Diversification of investment across multiple assets can facilitate the dispersion of risk.

Potential Considerations for Investors

While spot Bitcoin ETFs offer a range of advantages, it’s essential for investors to consider certain factors before making investment decisions.

Management Fees and Commissions

Investors should be aware that spot Bitcoin ETFs are not without costs. Expenses such as management fees and brokerage commissions still apply. However, these costs are offset by the convenience and efficiency offered by ETFs, balancing the equation for investors.

Market Factors

It’s crucial for investors to recognize that the value of spot Bitcoin ETFs can be influenced by various market factors beyond Bitcoin’s spot price. Factors such as market sentiment, regulatory developments, and technological advancements can impact the performance of these ETFs. Therefore, investors should stay informed and exercise due diligence when investing in spot Bitcoin ETFs.

Conclusion

In conclusion, spot Bitcoin ETFs represent a groundbreaking investment opportunity that combines the potential of cryptocurrencies with the familiarity and accessibility of traditional financial markets. By securely holding actual Bitcoins, offering unmatched convenience and liquidity, ensuring robust regulatory oversight, and providing distinct tax advantages, spot Bitcoin ETFs empower investors to navigate the cryptocurrency landscape with confidence.

As with any investment, it is essential for investors to conduct thorough research, assess their risk tolerance, and make informed decisions to capitalize on the benefits offered by spot Bitcoin ETFs.