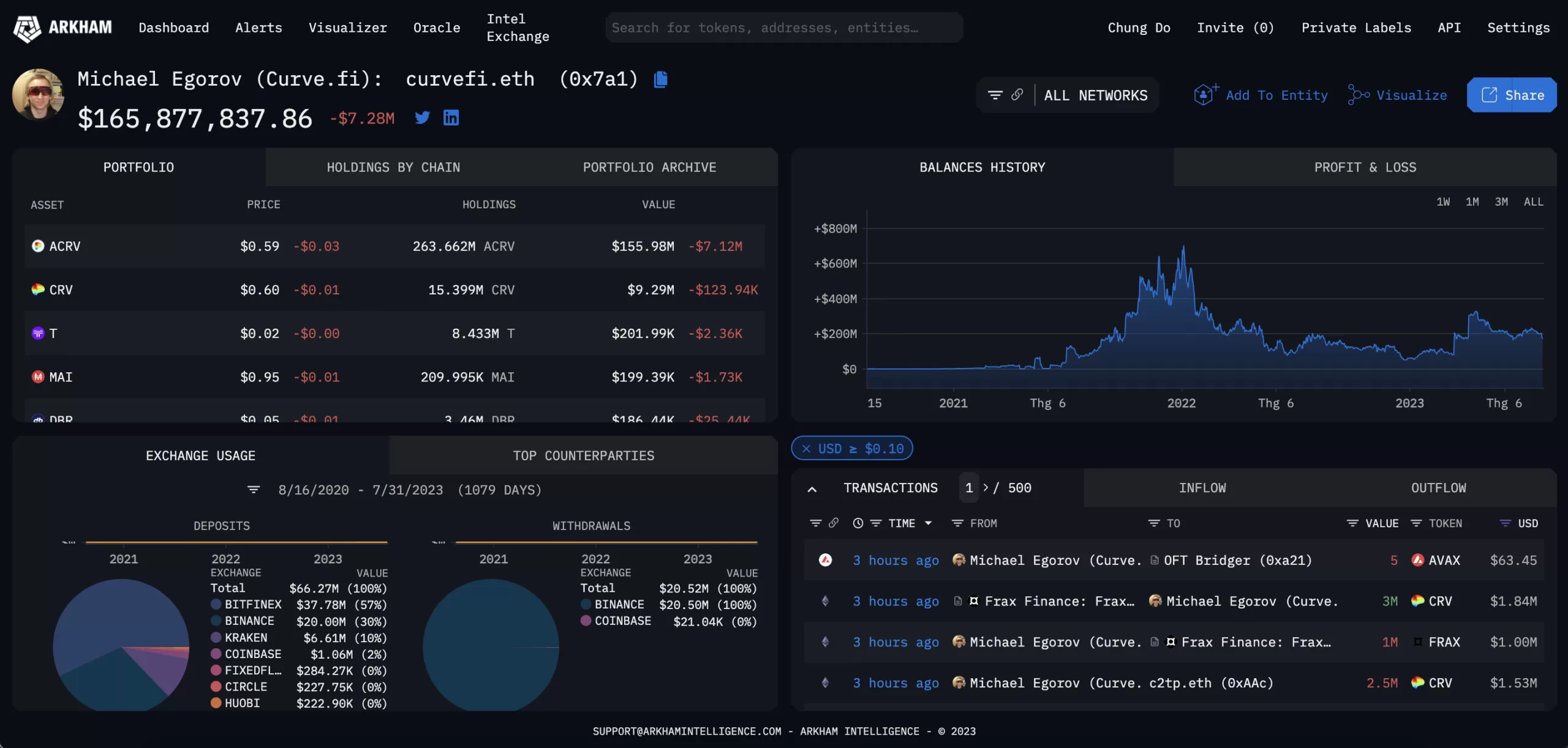

The recent exposure of the Vyper Vulnerability has sent shockwaves through the DeFi community, leading to a significant plunge in Curve’s native protocol token, CRV. As the price of CRV fell by over 30%, Michael Egorov, the CEO of Curve, finds himself in a precarious position with $168 million in CRV-backed loans from various DeFi protocols, including Aave, Abracadabra, and Fraxland.

CRV Market Volatility Puts Michael Egorov at Risk

The vulnerability’s revelation has left Michael Egorov with a looming concern, as his $168 million worth of CRV-backed loans faces a risk of liquidation due to the token’s shrinking value. These loans represent approximately 34% of CRV’s total market capitalization, intensifying the urgency to find a resolution amidst the market turmoil.

Data: https://platform.arkhamintelligence.com/

Egorov’s Loan Exposures

Michael Egorov’s loan exposure involves $168 million worth of CRV tokens on Aave, secured by a $63 million loan in USDT. In addition, he has $17 million in CRV-backed loans on Frax Finance and $18 million on Abracadabra. The liquidation price of the CRV stands at $0.37, adding to the pressure on Egorov’s positions.

Ripple Effect in the DeFi Ecosystem

The interconnected nature of the DeFi ecosystem heightens the impact of Egorov’s CRV positions on the overall stability of the system. The potential liquidation of these loans has raised concerns, as it could trigger a cascading effect in CRV’s market, affecting multiple protocols and projects within the DeFi space.

Analyst Warnings and Market Implications

Prominent analysts, such as Autism Capital on Twitter, have expressed alarm over Michael Egorov’s substantial CRV positions. If these positions reach the liquidation phase, it could have dire consequences for the DeFi sector, potentially leading to a massive sell-off of loan-secured CRV and further exacerbating the market downturn.

Vyper Vulnerability’s Role in the Crisis

The critical vulnerability in the smart contract language Vyper served as the catalyst for this crisis, placing various DeFi protocols at risk of exploitation. One of the major casualties was Curve, which suffered a loss of $47 million due to the exploit. The aftermath of the hack saw CRV’s value plummet by over 20%, contributing to the current market turbulence.

Charting a Path Forward

In the wake of the Vyper Vulnerability’s disclosure, the DeFi community, including Curve’s team, is diligently working to address the issue and implement necessary measures to fortify the ecosystem against similar attacks in the future. The incident has prompted a collective effort to strengthen security protocols and enhance risk management strategies.

Impact on DeFi’s Long-Term Viability

The recent events surrounding the Vyper Vulnerability and its impact on CRV have sparked discussions about the long-term viability and resilience of the DeFi space. As the sector continues to mature, the need for robust security practices and risk assessment frameworks becomes increasingly evident.

Navigating Uncertainty

While the DeFi ecosystem faces its share of challenges, industry leaders and stakeholders are collaborating to navigate the current uncertainties. The focus remains on building a sustainable and secure decentralized financial landscape that can withstand potential threats and emerge stronger from adversities.

Learning from Vulnerabilities

As the DeFi space learns from the Vyper Vulnerability incident, it underscores the importance of constant vigilance, prompt responses to security issues, and proactive efforts to safeguard users’ assets. By embracing a proactive approach to security, the industry can foster greater confidence among users and pave the way for a more robust and resilient future.