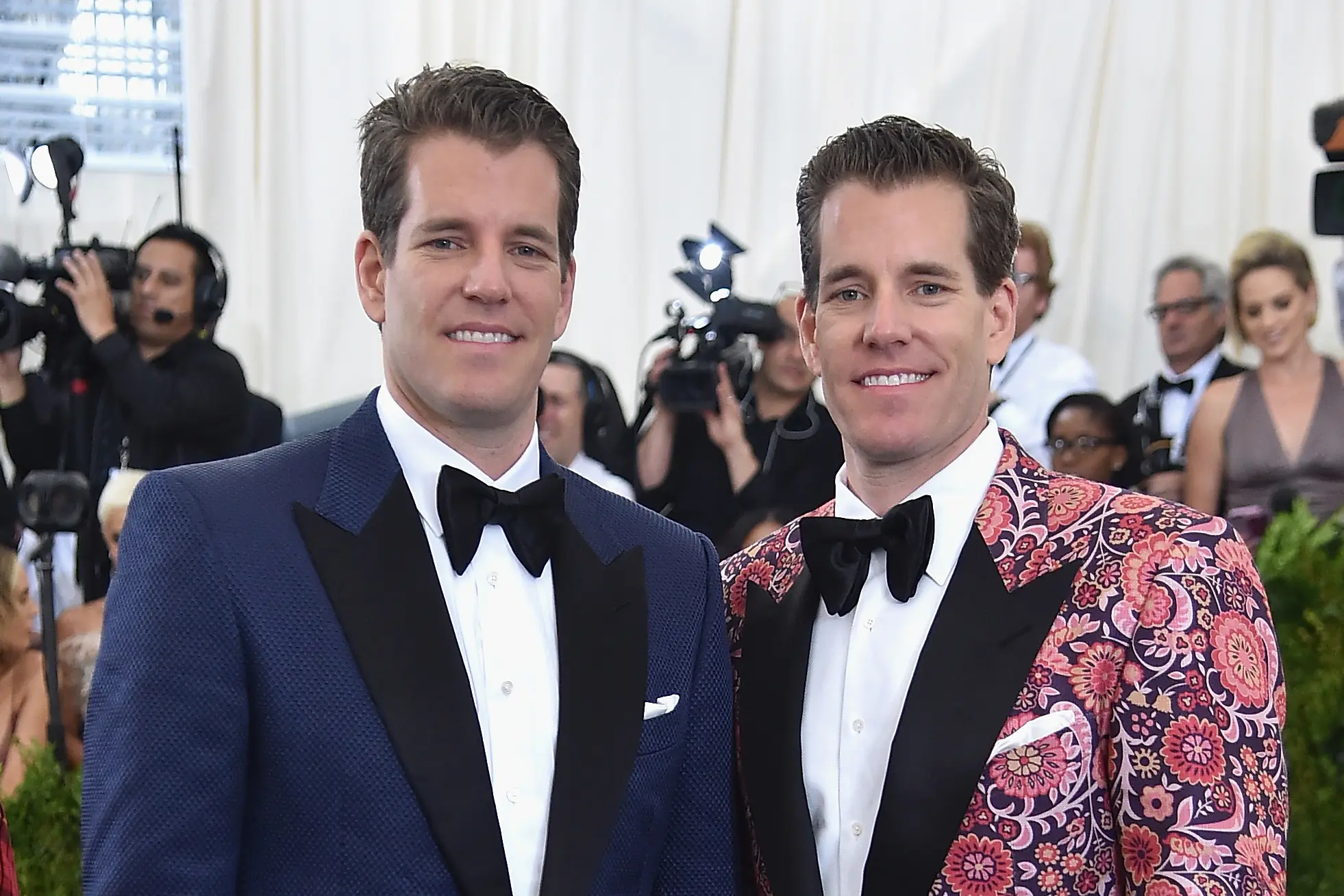

In a scathing critique of the U.S. Securities and Exchange Commission (SEC), Cameron Winklevoss, co-founder of Gemini, commemorated the 10th anniversary of his and Tyler Winklevoss’ first spot Bitcoin ETF filing. Winklevoss expressed deep disappointment in the SEC’s decade-long refusal to approve such products, asserting its detrimental impact on American investors. This article delves into the reasons behind Winklevoss’ criticism and examines the consequences of the SEC’s stance on spot Bitcoin ETFs.

Today marks 10 years since @tyler and I filed for the first spot Bitcoin ETF. The @SECGov‘s refusal to approve these products for a decade has been a complete and utter disaster for US investors and demonstrates how the SEC is a failed regulator. Here’s why:

-“protected”… pic.twitter.com/xmK1xo1iX8

— Cameron Winklevoss (@cameron) July 2, 2023

The 10-Year Anniversary of the First Spot Bitcoin ETF Filing

Ten years have passed since Cameron and Tyler Winklevoss filed for the first spot Bitcoin ETF. This landmark event marked their intention to create an investment vehicle that would allow investors to gain exposure to Bitcoin’s price movements without directly owning the cryptocurrency.

The SEC’s Role as a Regulatory Bod

The U.S. Securities and Exchange Commission plays a crucial role in protecting investors and maintaining fair and efficient markets. Its mandate involves overseeing various financial products, including ETFs, to ensure compliance with securities laws and regulations.

Impeding Investor Participation in Bitcoin’s Growth

Cameron Winklevoss expressed frustration over the SEC’s refusal to approve spot Bitcoin ETFs. By withholding approval, the SEC has hindered American investors from capitalizing on the remarkable growth of Bitcoin over the past decade.

The Precarious Alternatives: Grayscale Bitcoin Trust (GBTC)

Due to the lack of approved spot Bitcoin ETFs, investors have turned to alternatives like the Grayscale Bitcoin Trust (GBTC). However, the GBTC has faced criticism for its substantial discount to net asset value and the imposition of high fees.

Driving Spot Bitcoin Activity Offshore

Winklevoss argued that the SEC’s resistance to spot Bitcoin ETFs has inadvertently pushed Bitcoin activity offshore. Unlicensed and unregulated venues in other jurisdictions have gained prominence as a result, posing risks to investors who engage in transactions through these platforms.

Risks Associated with Unlicensed and Unregulated Venues

The absence of regulated spot Bitcoin ETFs has exposed investors to the potential risks of unlicensed and unregulated venues. These platforms may lack the necessary safeguards, increasing the likelihood of fraudulent practices and financial misconduct.

The FTX Scandal: A Notable Case of Financial Fraud

Cameron Winklevoss highlighted the FTX scandal as an example of the risks associated with unlicensed and unregulated venues. The FTX case stands as one of the largest financial frauds in recent history, further emphasizing the need for robust regulation and investor protection.

Reflections on the SEC’s Track Record

Looking ahead, Winklevoss urged the SEC to reflect on its track record regarding spot Bitcoin ETFs. He called for a reevaluation of the agency’s approach to ensure it aligns with the evolving landscape of digital assets and the growing demand for regulated investment vehicles.

Safeguarding Investors: The Core Mandate of the SEC

Throughout his critique, Winklevoss emphasized the fundamental responsibility of the SEC to safeguard investors’ interests. Approving spot Bitcoin ETFs could provide a regulated framework that promotes investor protection while enabling broader participation in the cryptocurrency market.

Advocating for the Introduction of Spot Bitcoin ETFs

In conclusion, Cameron Winklevoss expressed his support for all those advocating for the introduction of spot Bitcoin ETFs in the United States. He extended his best wishes to individuals and organizations working towards creating a regulatory environment that fosters innovation, investor confidence, and responsible market participation.

Conclusion

The SEC’s decade-long refusal to approve spot Bitcoin ETFs has been met with criticism from industry leaders like Cameron Winklevoss. The absence of regulated investment vehicles has impeded American investors’ ability to benefit from Bitcoin’s growth. It has led to the emergence of precarious alternatives and the migration of Bitcoin activity to unlicensed and unregulated venues. Reflecting on the SEC’s track record, Winklevoss called for a reevaluation of its approach and a renewed focus on safeguarding investors. As the industry evolves, the introduction of spot Bitcoin ETFs could provide a regulated framework that benefits both investors and the broader cryptocurrency market.

FAQs

1. What is a spot Bitcoin ETF?

A spot Bitcoin ETF is an investment vehicle designed to track the price movements of Bitcoin without requiring investors to directly own the cryptocurrency. It provides a regulated means for investors to gain exposure to Bitcoin’s performance.

2. Why has the SEC refused to approve spot Bitcoin ETFs?

The SEC’s refusal to approve spot Bitcoin ETFs stems from concerns over market manipulation, liquidity, and investor protection. The agency has been cautious about introducing new financial products tied to cryptocurrencies.

3. What are the risks associated with unlicensed and unregulated venues?

Unlicensed and unregulated venues may lack the necessary oversight and safeguards to protect investors. They pose risks such as fraudulent practices, security breaches, and potential loss of funds.

4. How does the Grayscale Bitcoin Trust (GBTC) work?

The Grayscale Bitcoin Trust (GBTC) is an investment vehicle that allows investors to gain exposure to Bitcoin through shares of the trust. However, it has faced criticism for its substantial discount to net asset value and high management fees.

5. Why is the approval of spot Bitcoin ETFs important?

The approval of spot Bitcoin ETFs would provide a regulated framework for investors to participate in the cryptocurrency market. It could enhance investor protection, foster market transparency, and contribute to the growth of the digital asset ecosystem.