Get ready for the next Bitcoin (BTC) halving in April 2024; it could send shockwaves through the cryptocurrency market. Here’s everything you need to know about this important event, including what it means and how you might capitalize on potential shifts.

What are Halvings?

Bitcoin halving is a programmed event where the reward for bitcoin mining is cut in half. This happens roughly every four years, reducing the rate at which new bitcoins enter circulation. The halving mechanism is crucial for controlling Bitcoin’s supply and ensuring its scarcity.

The Bitcoin halving is an essential feature of the cryptocurrency’s monetary policy that helps to control its inflation rate and ensure its long-term viability as a decentralized digital currency. It is a key event that bitcoin investors and enthusiasts closely monitor, as it has a significant impact on market dynamics and the future price of BTC.

How does Bitcoin halving work?

Bitcoin halving is an occasion that takes place every 4 years. Halving is set to occur after 210,000 blocks are mined, but the timing varies.

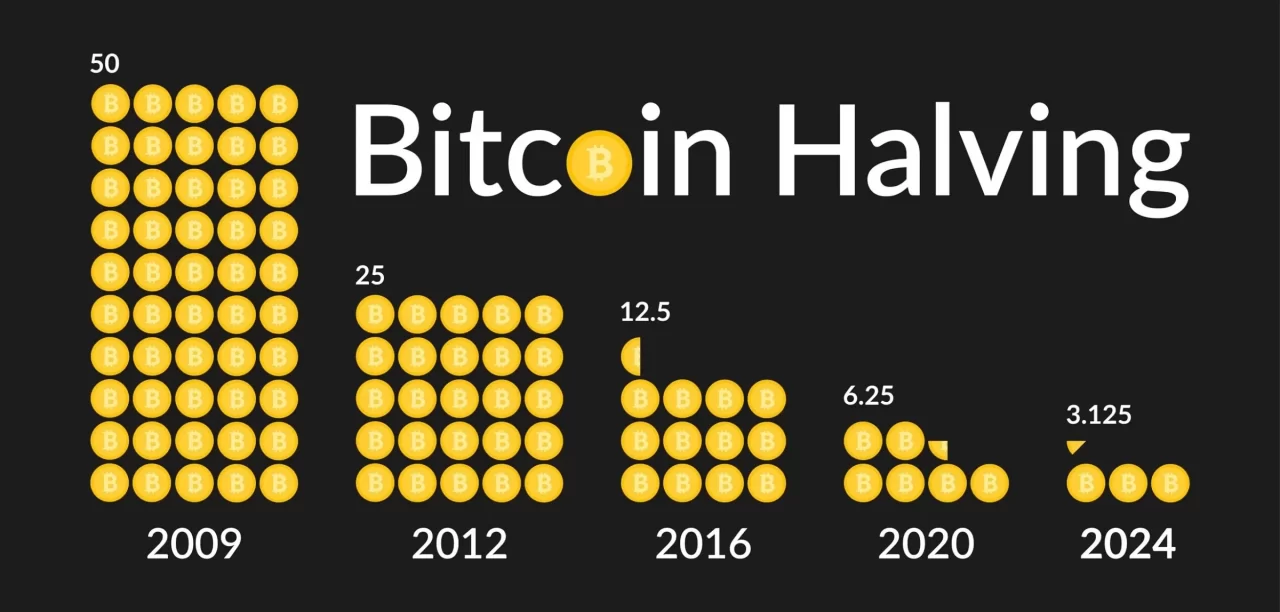

The mining reward started at 50 BTC per block when Bitcoin was released in 2009.

After the upcoming fourth halving, the block reward for miners will be 3.125 bitcoin, down from 6.25 bitcoin currently, leading to an annual supply issuance of just 0.9%.

With only 6.25 BTC per block being rewarded to miners, the demand for bitcoin could increase, potentially leading to price fluctuations in the market. Additionally, as the total supply of bitcoin is fixed, the supply of bitcoin will continue to decrease as bitcoins are mined, making bitcoin even more scarce.

The Bitcoin numbers and rewards halve with each event. Based on the current Bitcoin halving cycle and schedule, 100% of all Bitcoin will be mined sometime around the year 2140.

Why do Bitcoin halvings matter?

This reduction in the block reward is designed to control the supply of Bitcoin and prevent inflation. It also serves to create scarcity, as fewer new bitcoins are being mined and the existing supply becomes more valuable. This can have a positive impact on the price of BTC, as the decreased supply can drive up demand.

Halving introduces scarcity into the bitcoin system due to the following:

- Controlled Supply: Bitcoin has a fixed total supply of 21 million coins. Halvings slow down the creation of new bitcoin, making it progressively scarcer.

- Inflation Hedge: Unlike fiat currencies, Bitcoin halving events aim to prevent excessive inflation, potentially making it a store of value.

History of Halving and Its Impact Bitcoin’s Price

One of the key differences between the 2024 bitcoin halving could be the impact on price movement and price volatility.

Furthermore, the 2024 bitcoin halving event could also impact the transaction fee on the bitcoin network. With fewer bitcoins being rewarded to miners, the competition for processing bitcoin transactions could increase, leading to higher transaction fees for users. This could in turn affect the overall usability and affordability of using bitcoin for everyday transactions on the bitcoin blockchain.

It will be interesting to see how the market reacts to the fourth bitcoin halving and how it ultimately makes bitcoin even more valuable as a digital asset.

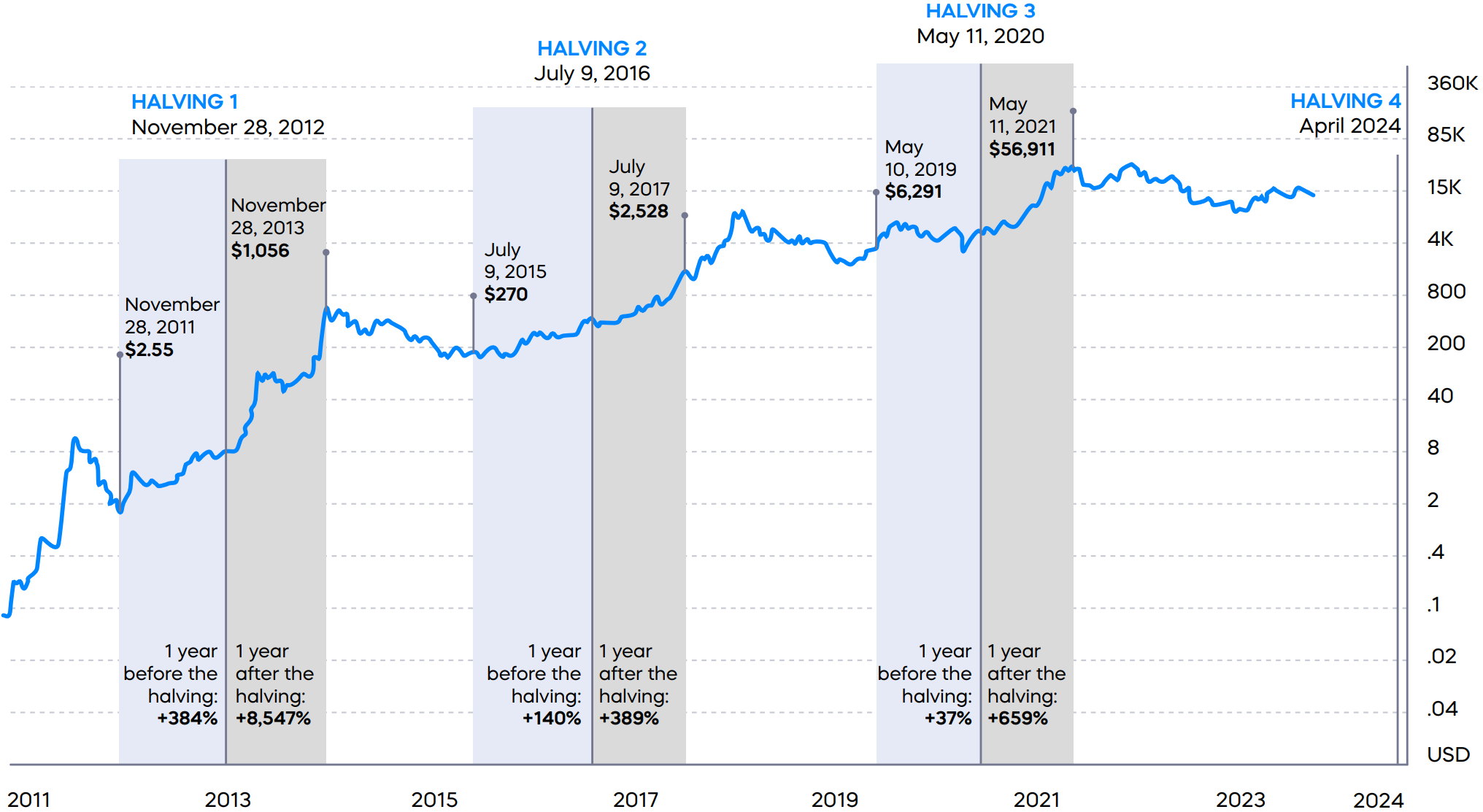

Historically, there has been a lot of Bitcoin price volatility leading up to and after a halving event.

Rob Chang, CEO of Gryphon Digital Mining

Historically, the bitcoin price has often surged after each halving event. Here are the specific figures:

- The first halving occurred in November 2012.: reduced block reward from 50 BTC to 25 BTC; price increase of 55,208%; price of BTC surged from around $12 to over $1000 within a year.

- Second halving in July 2016: reduced block reward from 25 BTC to 12.5 BTC; price increase of 11,274%; price of BTC rallied from around $650 to nearly $20,000 in 2017.

- The third halving in May 2020: reduced block reward from 12.5 BTC to 6.25 BTC; price increase of 1,888%; price grew from roughly $8,900 in May 2020 pre-halving to over $64,000 by May 2021.

Of course, past performance is not necessarily indicative of future results, and Bitcoin’s price is influenced by a variety of factors beyond just the halving event. However, many investors and analysts view the halving as a bullish signal for Bitcoin’s long-term price potential.

When is the next bitcoin halving?

The next Bitcoin halving is expected to occur in April 2024. Because the timing of each block varies, the exact date can’t be predicted with certainty.

However, based on current block production rates of about 10 minutes per block, the approximate date for the next Bitcoin halving is estimated to be around April 13, 2024.

Key Differences in the Next Halving in 2024

The 2024 halving event will be different from previous ones in several ways:

The Emergence of Spot Bitcoin ETFs: The influx of capital from these ETFs is expected to continue to flow into the crypto market, pushing the price of BTC higher.

Evolving Bitcoin Ecosystem: New innovations such as Ordinals, Inscriptions, and Bitcoin Layer 2 are attracting the attention of investors and developers, opening up huge growth potential for Bitcoin.

Macroeconomic Factors: Bank interest rates are expected to decline gradually in 2024, creating favorable conditions for risky assets like Bitcoin.

Factors That Can Affect the Bitcoin Price After Halving

Spot Bitcoin ETF Inflows: This flow of capital is expected to continue to enter the market, creating buying pressure on the price of BTC.

Selling pressure from GBTC and Bitcoin holders: Grayscale Bitcoin Trust (GBTC) and profitable Bitcoin investors may sell, putting downward pressure on the price of BTC.

Macroeconomic Factors: Inflation and the monetary policies of central banks can also affect the price of Bitcoin.

Investment Strategies After Halving

Focus on Long-Term Projects: After each Bitcoin bull run, altcoins tend to experience strong growth.

Pay Attention to the Bitcoin Ecosystem: Projects within the Bitcoin ecosystem such as Ordinals, Inscriptions, and Bitcoin Layer 2 have great growth potential.

Diversify Your Portfolio: Do not put all your capital into Bitcoin; instead, invest in potential altcoins and other assets to minimize risk. Stay informed on market trends: Keep up-to-date with news, events, and developments in the cryptocurrency market to make informed investment decisions.

Conclusion

The 2024 halving event is expected to significantly reshape the cryptocurrency landscape. The potential impact on the price of BTC per block when Bitcoin halves will be influenced by factors like Spot Bitcoin ETF capital flows, the Bitcoin ecosystem’s ongoing development, and broader macroeconomic trends. Investors should carefully consider their strategies to maximize their potential gains.

Note: This article is for informational purposes only and does not constitute investment advice. Please do your own research and make your own investment decisions.