Gas fees play a crucial role in the Ethereum ecosystem, determining the cost of executing transactions and running smart contracts. The fees fluctuate based on network demand, and recently they witnessed a substantial increase due to the surge in memecoin trading. However, the gas fees have now shown a downward trend, approaching levels seen two months ago.

The Decline in Gas Fees

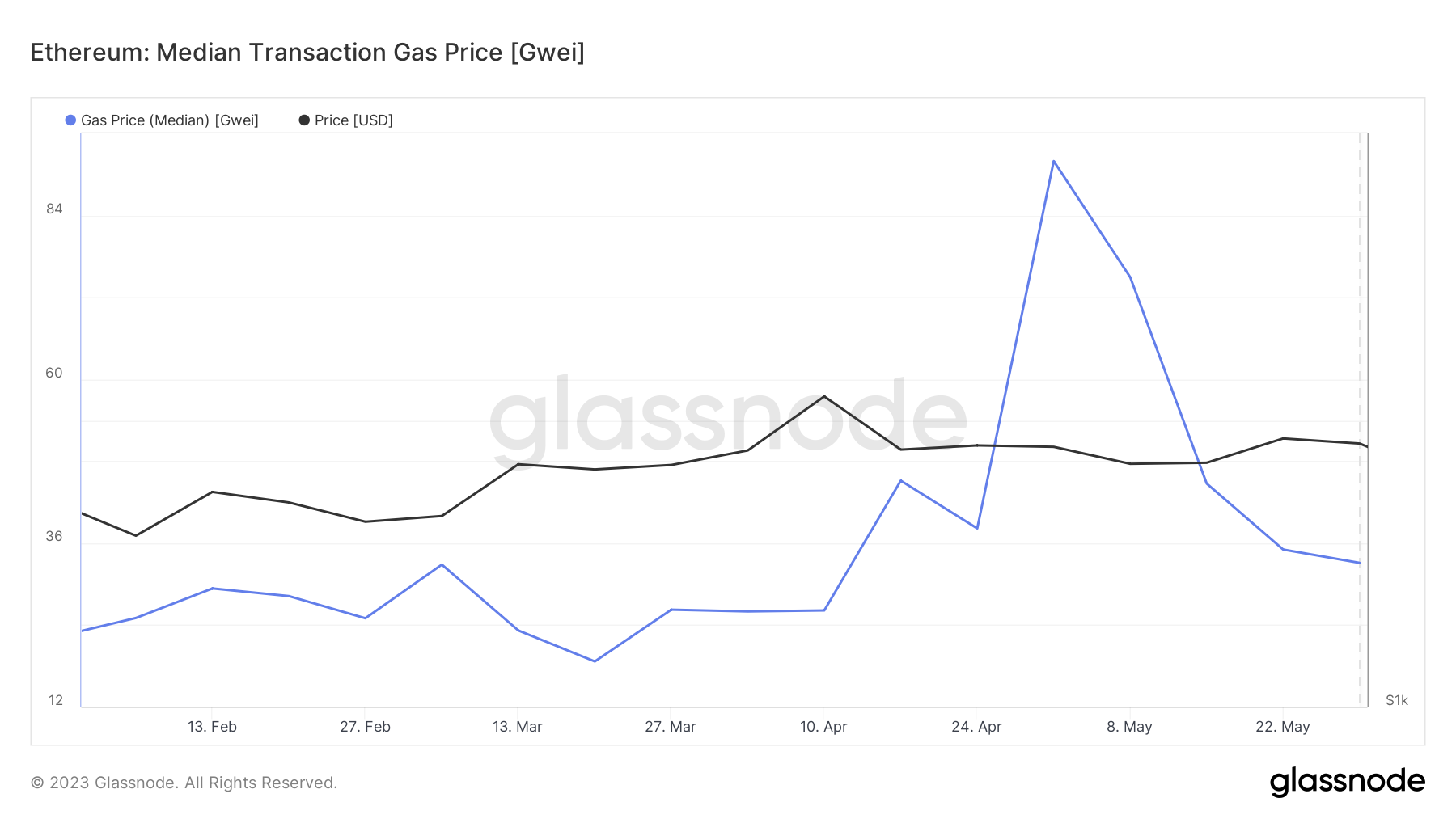

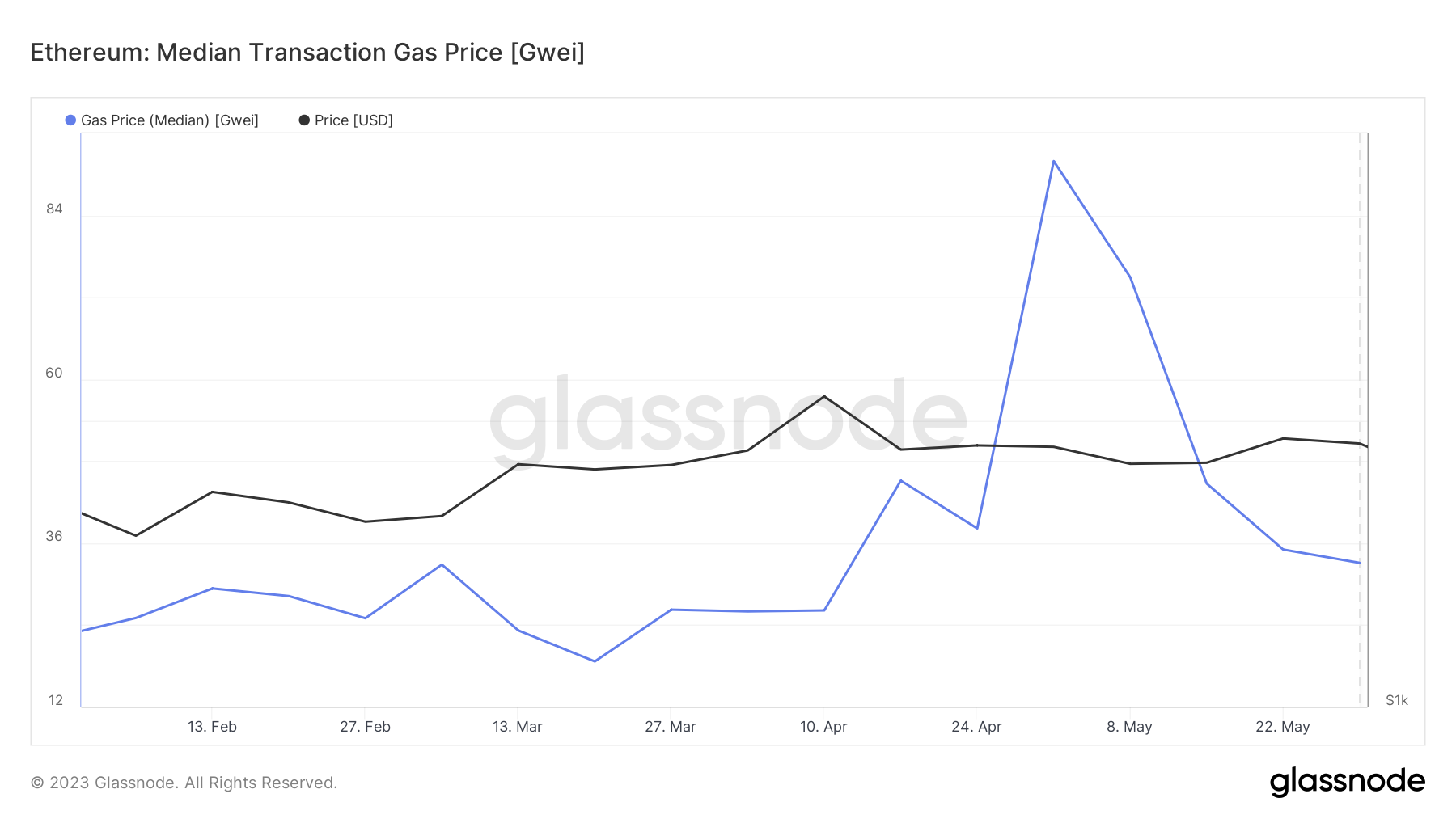

Based on the data obtained from Glassnode, the average transaction price on the Ethereum network has decreased to 33.4 gwei, as calculated using a seven-day moving average. This decline follows a previous high of over 107.61 gwei witnessed in the previous month. Interestingly, the fee level has now reached a point comparable to April 17, when it stood at 30 gwei. In simpler terms, the prices have dropped from $20 to $7.3.

Insights from Glassnode Data

Insights provided by Dune Analytics user @hildobby indicate that the median gas price per day has declined from its previous peak of over 140 gwei to 24 gwei. The current price level matches that of April 12, indicating a return to similar levels witnessed earlier this year. These findings highlight the downward trajectory of gas fees and a potential stabilization of the Ethereum network.

Impact on Bitcoin Transaction Fees

The significant surge in memecoin trading witnessed in May had a notable impact on the gas prices of the Ethereum network. As a result, the transaction fees of Bitcoin were also affected. Bitcoin’s average transaction fee surged to a level nearly five times higher than before, reaching a two-year peak at $31.14. This increase in transaction fees is attributed to the emergence of Ethereum-based “BRC-20” tokens, which have become the preferred standard for memecoins such as Ordinal tokens and PEPE coin. These factors have contributed to the rise in Bitcoin transaction fees.

Downward Pressure on Ethereum Price

In line with the decrease in average transaction fees on the Ethereum network, the price of ETH has been experiencing downward pressure in recent days. As of the time of writing, the Ethereum price stands at $1,870, reflecting a 1.8% decline overnight. The decline in gas fees and its impact on the overall Ethereum ecosystem, combined with market forces, have influenced the price of ETH in the short term.

Conclusion

The average gas fee on the Ethereum blockchain is currently approaching its lowest point in two months. After experiencing a surge in cost during the memecoin trading craze, gas fees have started to decline. The decrease in fees indicates a return to levels witnessed earlier this year, alleviating the burden on Ethereum users. Furthermore, this decline has had an impact on Bitcoin transaction fees and exerted downward pressure on the price of ETH.

FAQs

1. What are gas fees on the Ethereum blockchain? Gas fees on the Ethereum blockchain represent the cost of executing transactions and running smart contracts. They are paid by users to incentivize miners to include their transactions in blocks.

2. Why did gas fees surge during the memecoin trading craze? The surge in memecoin trading increased network demand on the Ethereum blockchain, leading to higher gas fees. Memecoins like Ordinal tokens and PEPE coin relied on the Ethereum network, driving up transaction costs.

3. How does the decrease in gas fees impact Bitcoin transaction fees? The decrease in gas fees on the Ethereum network had a reverse effect on Bitcoin transaction fees. As Ethereum-based memecoins experienced a surge, the transaction fees for Bitcoin also increased.

4. Will the decline in gas fees continue? The decline in gas fees indicates a return to previous levels, but it’s difficult to predict the future trajectory. Gas fees depend on network demand, which can fluctuate based on various factors.

5. How does the decrease in gas fees affect Ethereum’s price? The decrease in gas fees exerts downward pressure on Ethereum’s price in the short term. Market forces, combined with the impact of gas fees on the overall Ethereum ecosystem, contribute to price fluctuations.