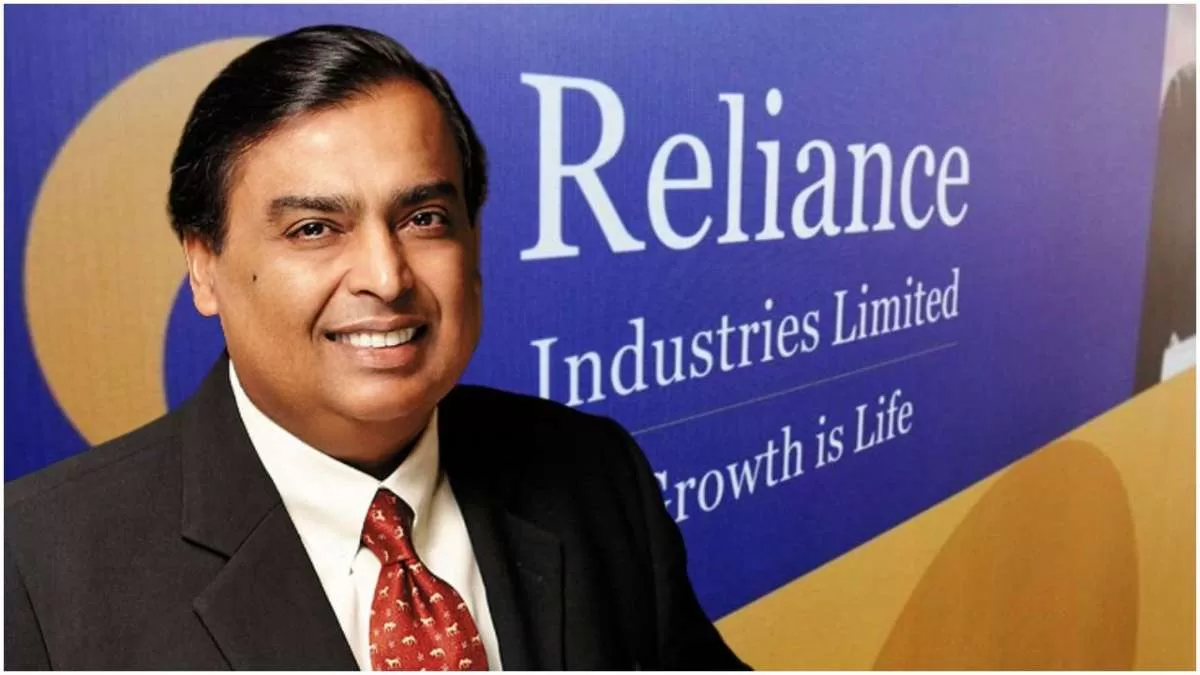

Mukesh Ambani, the chairman of Reliance Industries Ltd., has revealed the company’s entry into India’s Central Bank Digital Currency (CBDC) space and the blockchain realm through its financial services arm, Jio Financial Services. With the establishment of a joint venture with BlackRock, Reliance aims to provide accessible and secure investment solutions, leveraging digital technology and adhering to regulatory standards.

Reliance Industries Ventures into CBDC Development and Blockchain

Mukesh Ambani, the visionary behind Reliance Industries Ltd., has unveiled the company’s strategic move to explore India’s Central Bank Digital Currency (CBDC) development and delve into the world of blockchain technology. This announcement was made during the company’s Annual General Meeting (AGM), a significant event that marks Reliance’s commitment to innovation and growth.

Empowering Digital Financial Services

Jio Financial Services (JFS), a subsidiary of Reliance Industries, is at the forefront of this transformative initiative. Ambani revealed that JFS is partnering with global investment management firm BlackRock to establish an asset management business that aims to provide accessible and trustworthy investment solutions for individuals across India. This digital-first approach seeks to revolutionize asset management by offering innovative and affordable investment opportunities.

Digital Adoption and Payment Infrastructure

Ambani outlined the comprehensive vision for JFS, indicating its role in consolidating payment infrastructure to serve both consumers and merchants. This consolidation is poised to drive digital adoption throughout India, aligning with the country’s growing digital ecosystem.

Blockchain and CBDC Integration

Highlighting Reliance’s commitment to technological excellence, Ambani announced that JFS is not only focused on industry benchmarks but is also exploring cutting-edge features such as blockchain-based platforms and Central Bank Digital Currency (CBDC). These initiatives are designed to adhere to the highest standards of security and regulatory compliance while ensuring the utmost protection of customer transaction data.

Reliance’s Forward-Thinking Integration

Reliance Retail, the largest retail chain in India, took a significant step forward by accepting India’s digital rupee (CBDC) in its initial phase in February 2023. This strategic integration showcases Reliance’s forward-thinking approach and contributes to India’s progress in adopting wholesale and retail CBDC solutions.

Shaping India’s Digital Financial Landscape

Mukesh Ambani’s announcement signifies Reliance’s dedication to innovation, technology, and financial inclusivity. By embarking on the CBDC development journey and embracing blockchain technology, Reliance Industries is poised to play a pivotal role in shaping India’s digital financial landscape, offering secure, accessible, and transformative solutions to millions of investors and consumers across the nation.