Recent surveys conducted in the UK and Canada have shed light on public sentiment regarding central bank digital currencies (CBDCs). The surveys, conducted by Trezor in the UK and WealthRocket in Canada, revealed widespread apprehension among the public regarding the implications of CBDCs.

The UK survey conducted by Trezor found that a majority of Brits expressed concerns about granting authorities control over their funds. Additionally, 67% of respondents were troubled by the possibility that CBDCs could expire, resulting in the loss of funds if not spent. Worries were also expressed about government control over the types of goods and services that could be purchased using CBDCs.

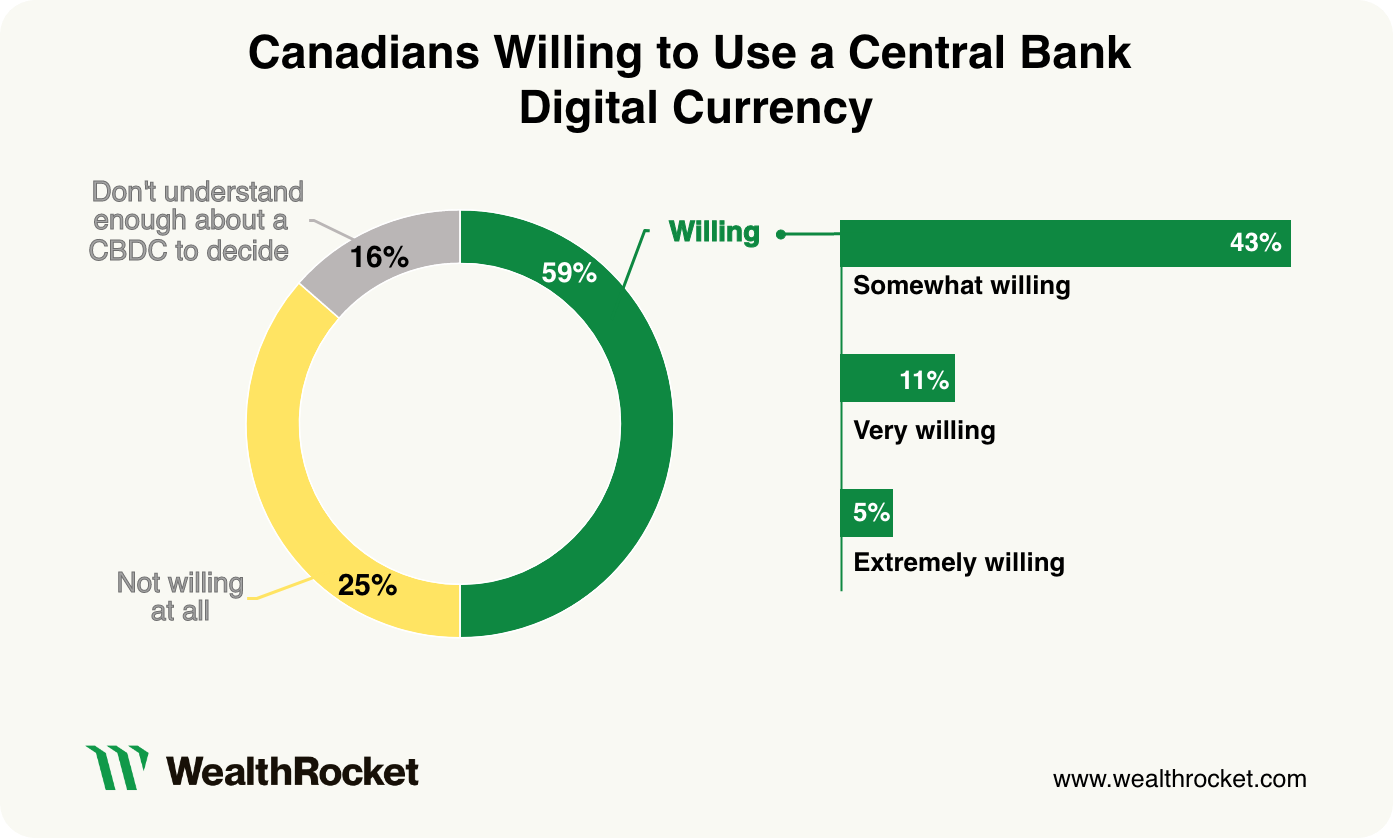

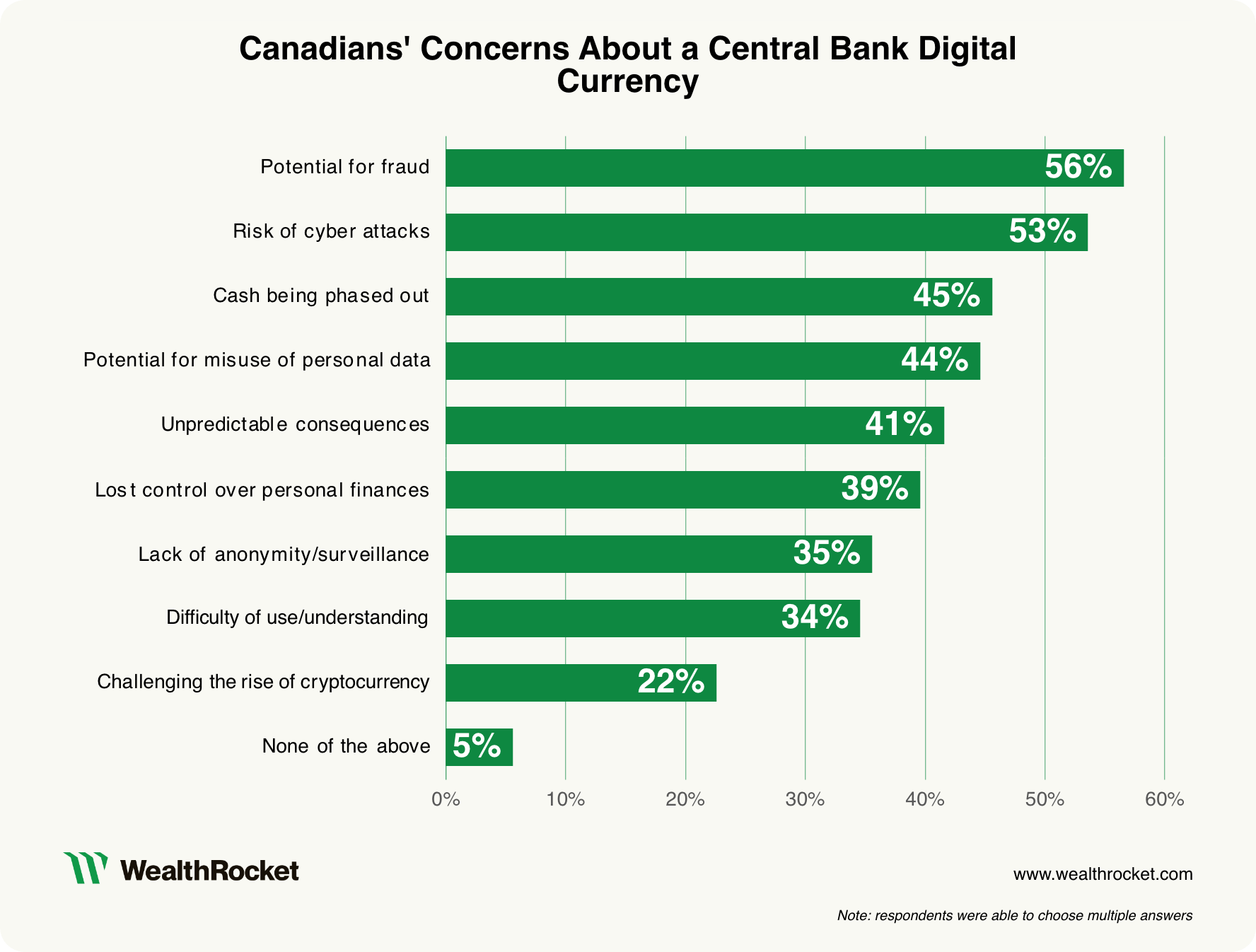

Similarly, the survey conducted by WealthRocket in Canada revealed that 39% of respondents were concerned about the potential loss of control over their finances with the introduction of a CBDC. The survey also highlighted concerns related to fraud, cyber attacks, and the potential elimination of cash. Interestingly, the idea of a digital dollar rivaling cryptocurrencies was the least common concern among Canadians.

These surveys come as the public comment periods for CBDCs conclude in both countries. While the Bank of Canada has no immediate plans to issue a CBDC, it continues to explore the technology in case of future parliamentary requests. In the UK, the Bank of England and HM Treasury have been investigating the possibility of a digital pound, but a consensus on pursuing a CBDC has not been reached.

The findings of these surveys align with previous research from the Cato Institute, which indicated that only 16% of Americans support the adoption of a CBDC, with greater opposition among Republicans than Democrats. Additionally, large banks like JPMorgan perceive CBDCs as a government-backed threat to their business operations.

As discussions surrounding CBDCs continue, there is a growing recognition of the need for comprehensive public debates to address citizens’ concerns. The surveys underscore the importance of engaging ordinary people in these discussions and considering their viewpoints before proceeding with the rollout of CBDCs.

Compiled by Coinbold