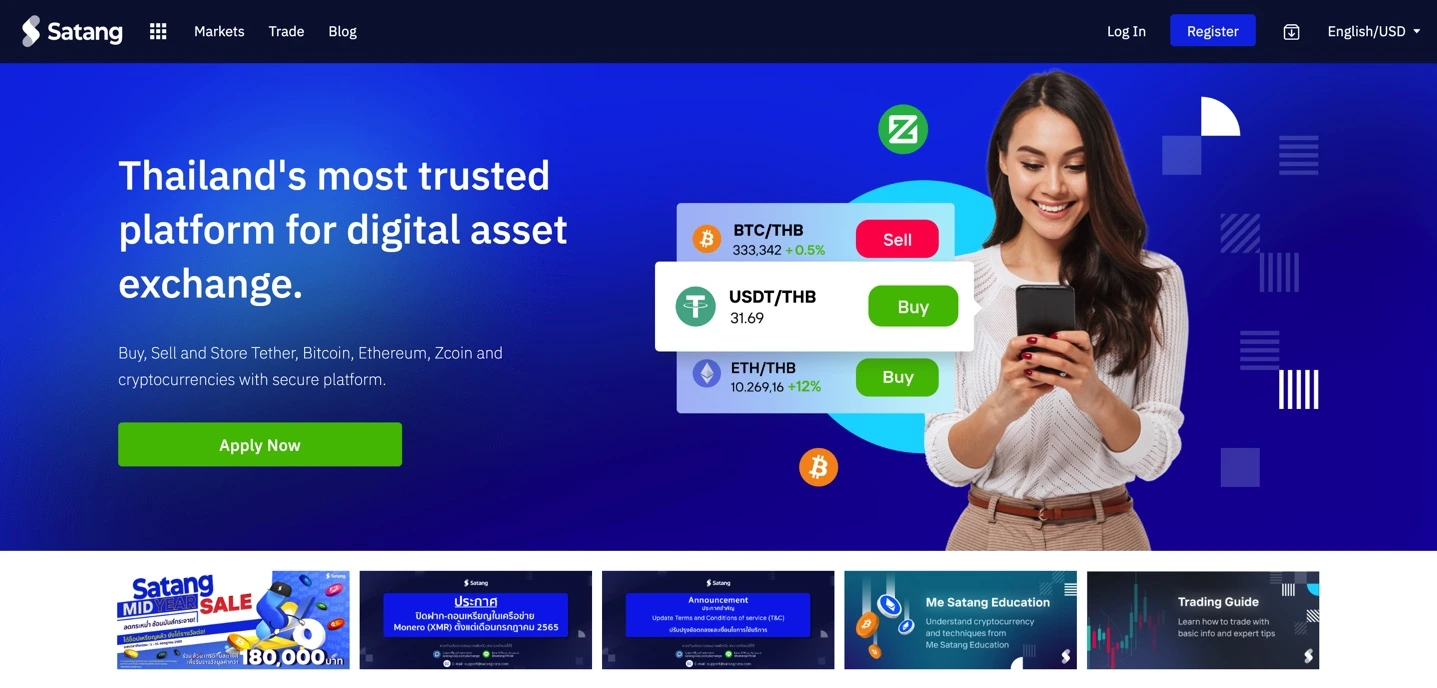

In a groundbreaking development shaping Thailand’s financial landscape, Kasikorn Bank, widely known as K-Bank, has taken a bold step into the realm of cryptocurrencies. The banking giant has successfully acquired a majority stake of 97% in the company that owns Satang, a prominent cryptocurrency exchange that has been a significant player in Thailand’s crypto sphere since 2017.

The monumental deal, valued at a staggering 3.705 billion Thai baht (equivalent to $102.8 million), was executed through K-Bank’s innovative subsidiary, Unita Capital. This subsidiary specializes in strategic investments in companies deeply involved in the world of digital assets, marking a strategic move for K-Bank into the thriving crypto market.

K-Bank’s vision for this venture is clear: it aims to secure an impressive 20% share of the crypto market in Thailand by 2024. This ambitious goal underscores the bank’s commitment to becoming a major player in the rapidly evolving cryptocurrency landscape of the region.

Following the completion of this groundbreaking acquisition, Satang will undergo a significant transformation. The exchange will be rebranded as Orbix, heralding a new era in its journey. Alongside the rebranding, three pivotal branches will emerge within the newly formed entity: Orbix Custodian, Orbix Invest (dedicated to managing digital asset funds), and Orbix Technology (focused on the development of cutting-edge blockchain technology). These strategic additions highlight K-Bank’s comprehensive approach, aiming not only to acquire but also to innovate and expand within the crypto space.

This strategic move by K-Bank comes hot on the heels of its initiation of a $100 million fund designed to support innovative projects within the realms of web3, fintech, and artificial intelligence. The bank’s proactive stance reflects a broader trend within the Thai banking sector, where competitors such as Siam Commercial Bank (SCB) are also actively exploring opportunities in the burgeoning fields of web3 and cryptocurrency.

As Thailand’s financial landscape undergoes this transformative shift, K-Bank’s acquisition of Satang stands as a testament to the evolving dynamics of the digital asset industry. Stay tuned as this partnership unfolds, reshaping the future of cryptocurrencies in Thailand and beyond.