In a groundbreaking collaboration, Glassnode and Ark Invest have unveiled the Cointime Economics model for Bitcoin. This innovative framework introduces a suite of analysis tools, over 30 new metrics, and improved valuation models, aiming to provide a comprehensive understanding of Bitcoin’s economic dynamics.

A New Era in Bitcoin Analysis: Cointime Economics

In an era of rapid technological advancement, the blockchain data firm Glassnode and the crypto-focused investment firm Ark Invest have joined forces to introduce a revolutionary model for analyzing Bitcoin. This collaborative effort has given birth to the Cointime Economics framework, which sets out to redefine the way we comprehend and analyze the economic aspects of Bitcoin.

Cointime Economics: Unveiling a Comprehensive Framework

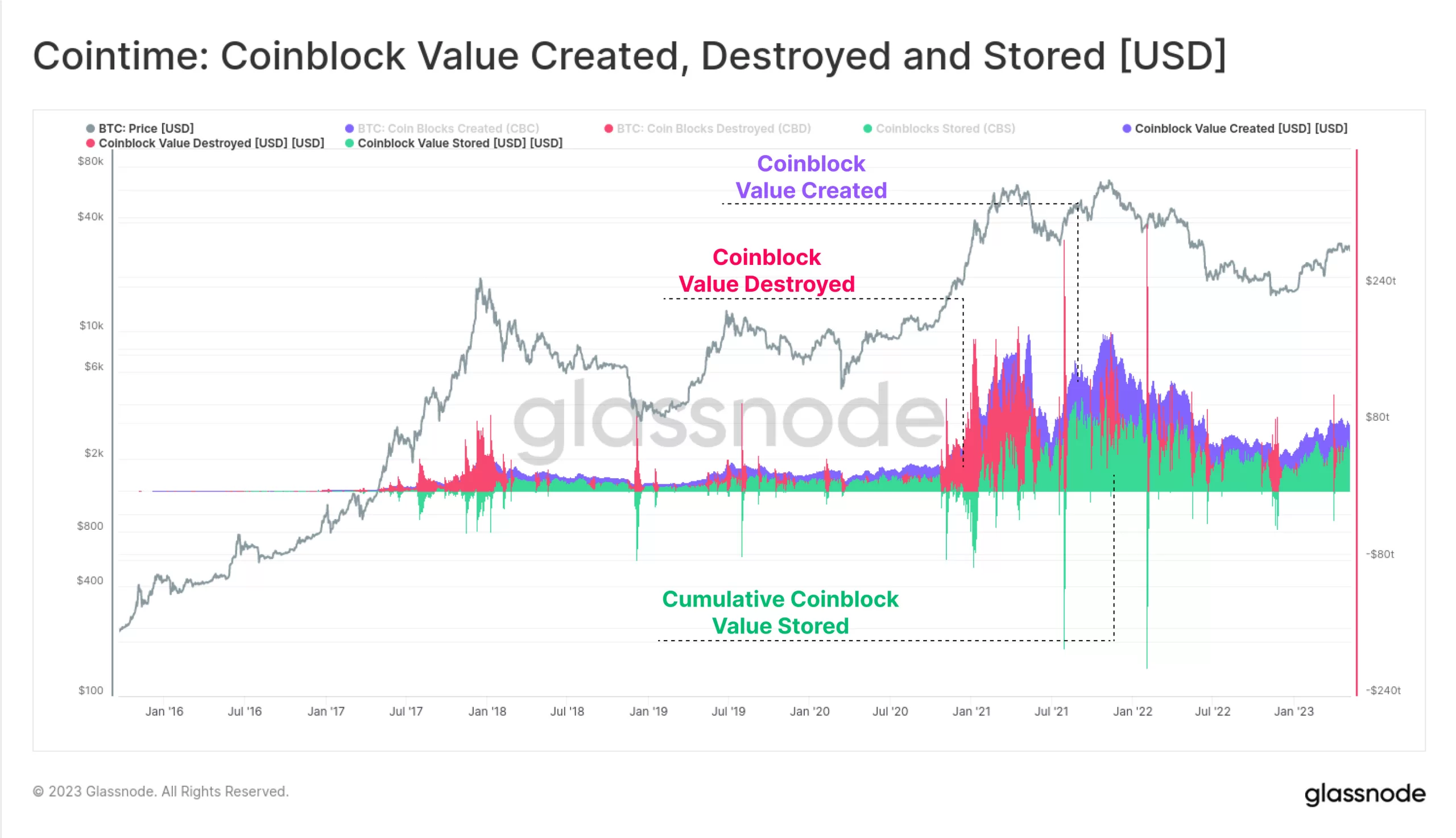

The heart of this novel model lies in its name: Cointime. This framework introduces a custom suite of analysis tools and over 30 new network metrics, effectively reshaping the landscape of Bitcoin analysis. With a strong focus on precision and depth, Cointime Economics enhances existing pricing models and valuation methods, promising a more comprehensive view of Bitcoin’s economic behavior.

Understanding the Core Concepts

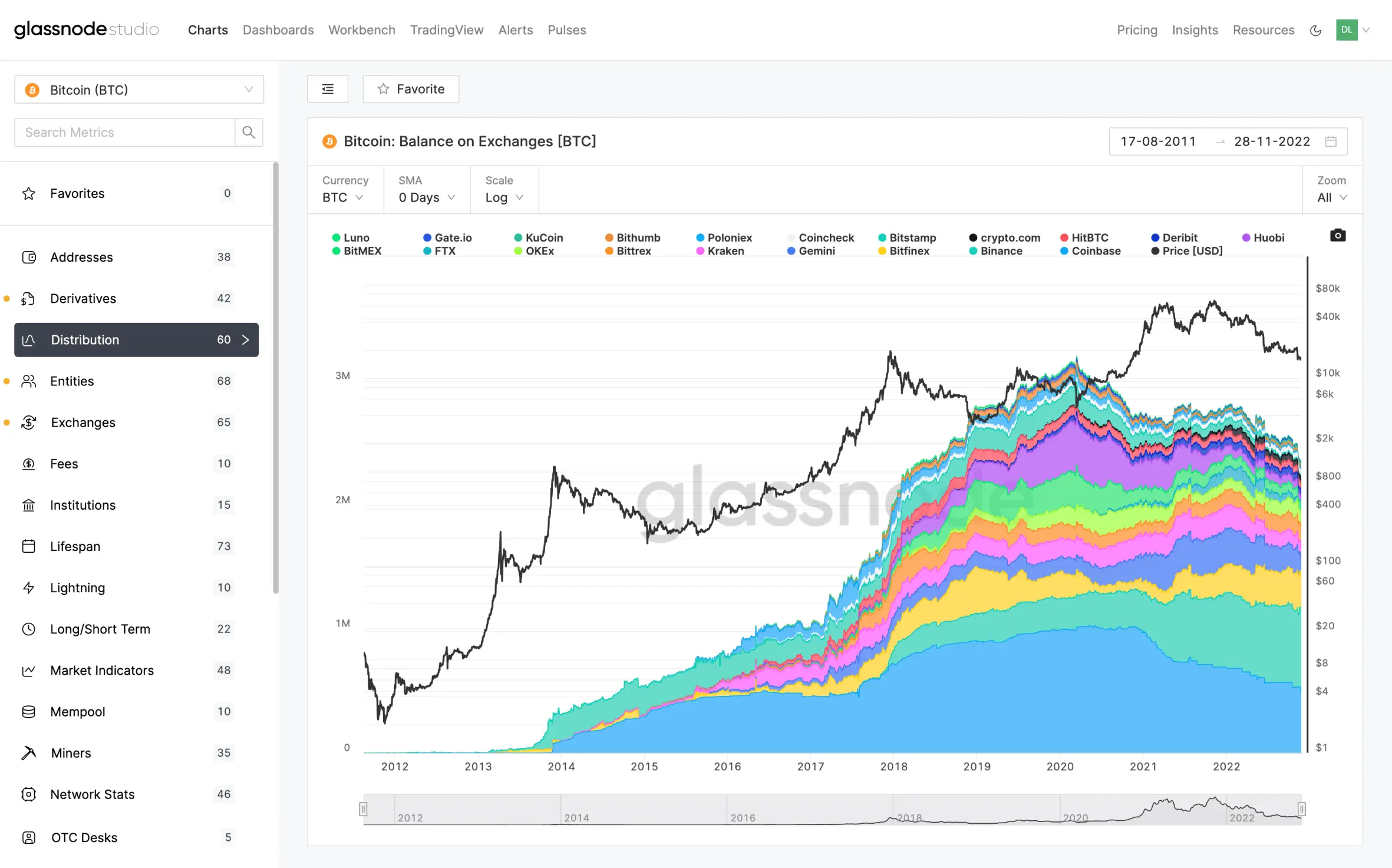

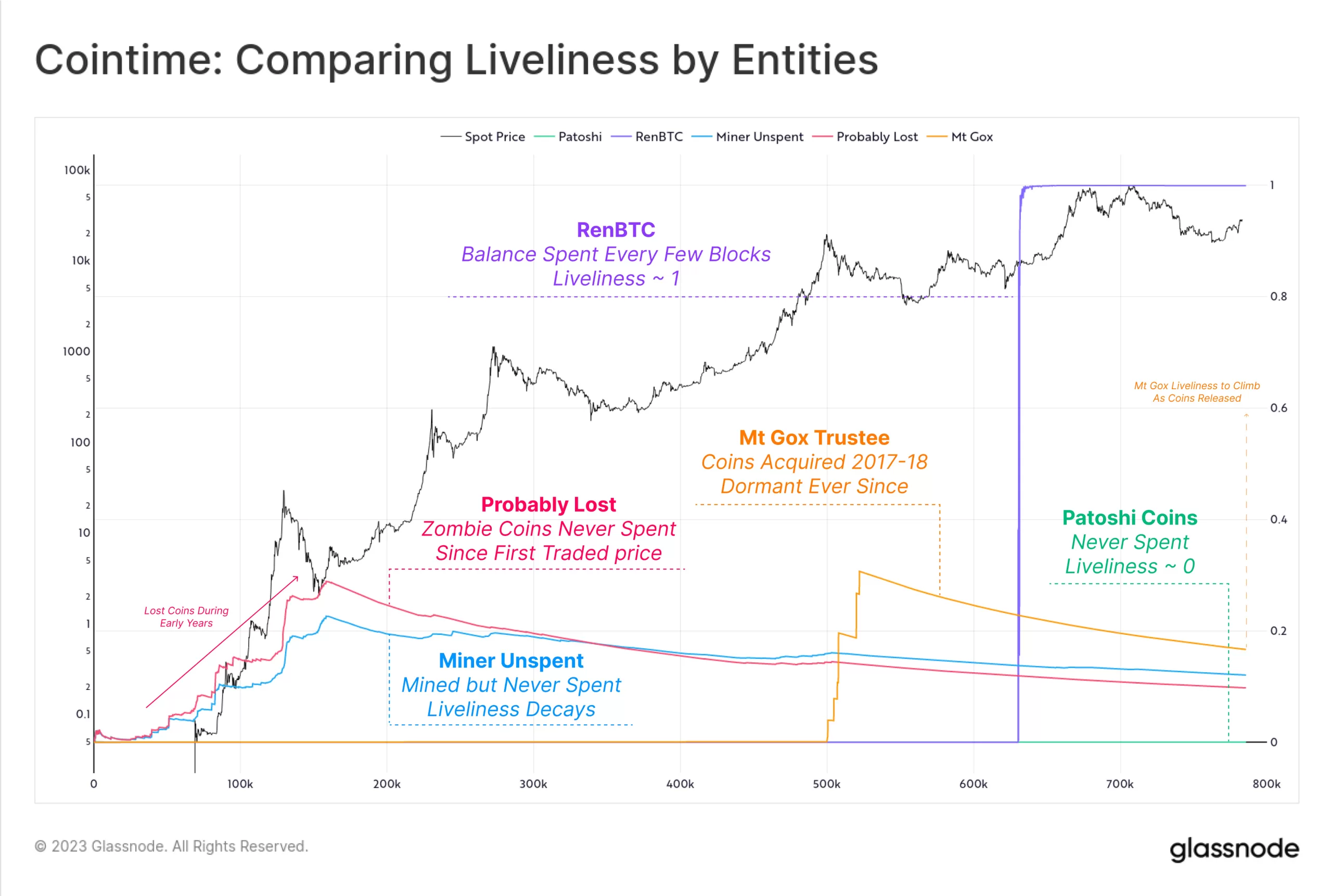

Glassnode explains that Cointime Economics draws its foundation from the concept of the coinblock, a fundamental unit within the Bitcoin network that represents a dimension of coin supply. This framework ingeniously divides coin supply into two distinct regions: Active and Vaulted. This division serves as the bedrock upon which Cointime Economics is built, paving the way for a new perspective on Bitcoin’s economic landscape.

Balancing Supply and Demand: The Power of Cointime

One of the central strengths of the Cointime Economics model lies in its ability to address the intricate balance of supply and demand within the Bitcoin ecosystem. By providing tools to account for lost and inactive Bitcoin supply, Cointime Economics can precisely compute critical factors like inflation rates, stock-to-flow ratios, and velocity. These metrics illuminate the delicate equilibrium that shapes Bitcoin’s supply-demand dynamics.

Enriching Valuation Models with Innovative Ratios

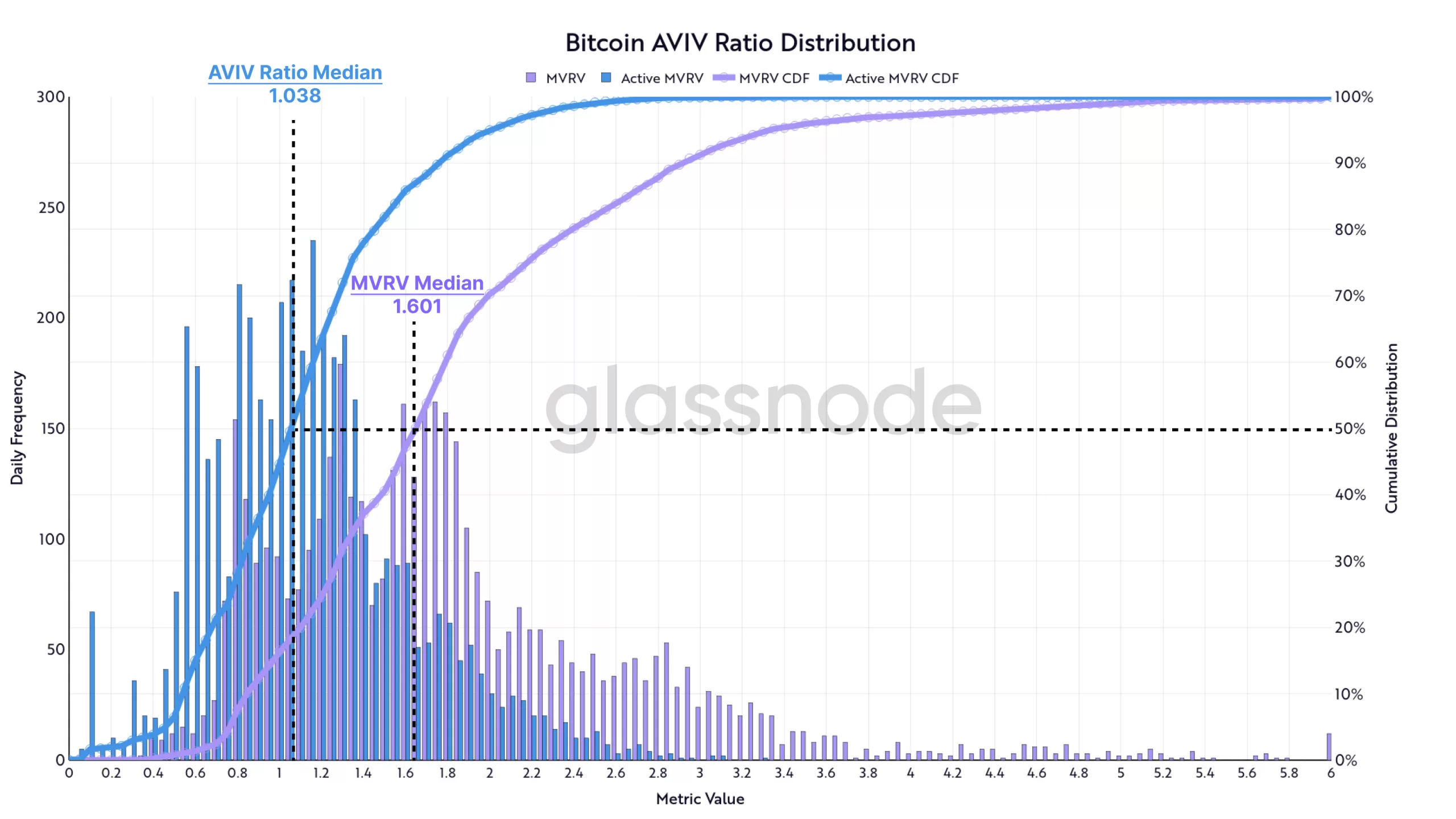

Cointime Economics doesn’t stop at enhancing existing valuation models—it introduces new dimensions to valuation analysis. Among these innovations is the Active Value to Investor Value (AVIV) ratio, which complements traditional valuation methods like the market value to realized value (MVRV) ratio. This comprehensive approach enables a deeper understanding of Bitcoin’s valuation dynamics.

A Blueprint for True Market Understanding

Through the Cointime Economics framework, Glassnode establishes the True Market Mean, a Bitcoin cost basis model that promises to provide a clearer perspective on Bitcoin’s market dynamics. This novel approach to market analysis adds a layer of depth and accuracy to the existing toolkit of Bitcoin analysts and enthusiasts alike.

A Collaborative Endeavor for Progress

The unveiling of the Cointime Economics model is accompanied by an insightful report authored by James Check, Lead Analyst at Glassnode, and co-authored by ARK’s Research Associate David Puell. This collaborative effort between Glassnode and Ark Invest underscores their commitment to pushing the boundaries of Bitcoin analysis and delivering enhanced insights to the crypto community.

As the Cointime Economics model gains traction, its innovative tools and metrics are poised to reshape the way we understand, analyze, and interact with Bitcoin’s intricate economic landscape.