The Hong Kong Stock Exchange (HKEX) is set to launch a new blockchain-based platform called HKEX Synapse aimed at improving the post-trade process for its Stock Connect program with mainland China.

By automating settlement steps with smart contracts, HKEX aims to boost efficiency, transparency and accuracy for the cross-border investment scheme.

Automating Settlement With Blockchain

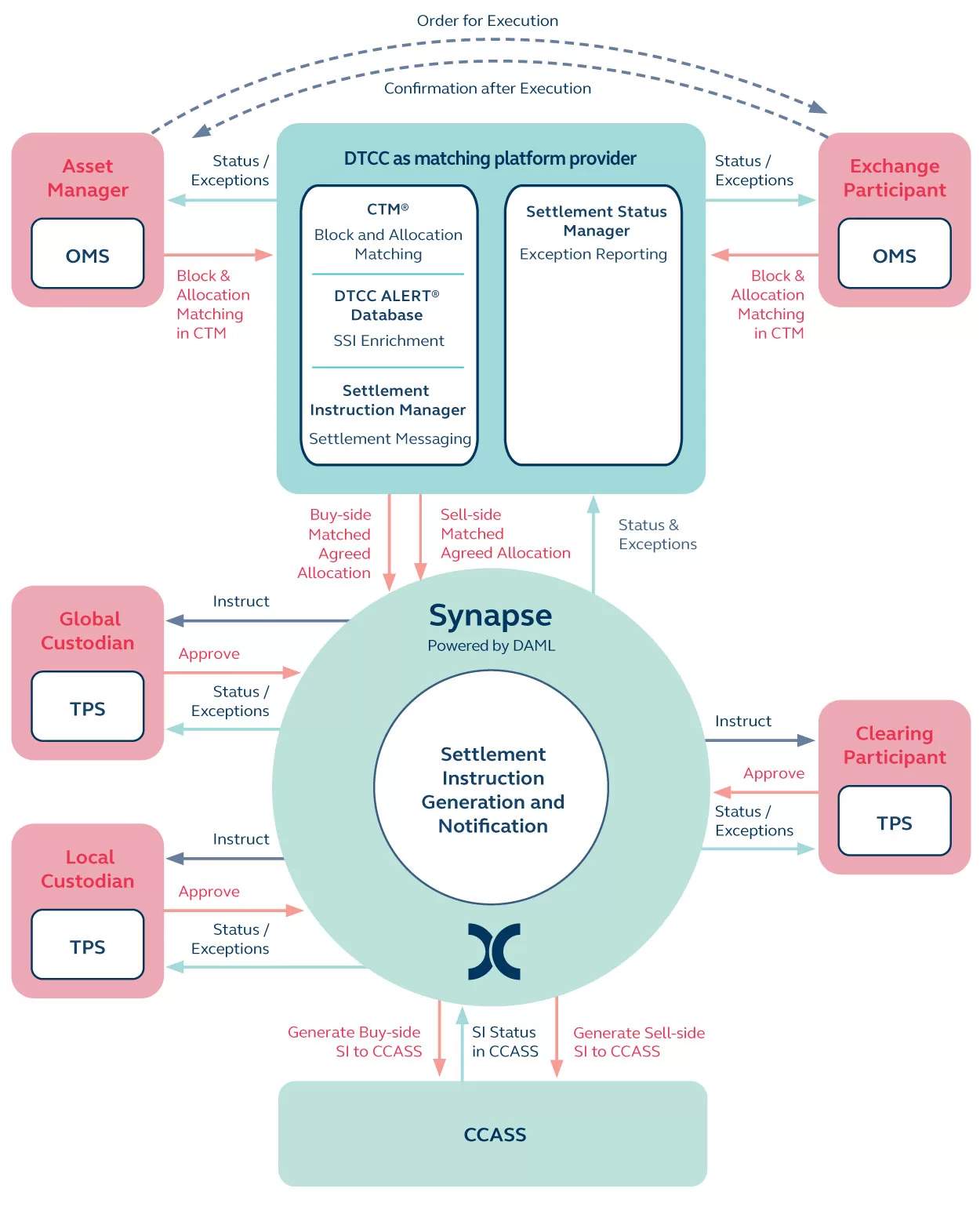

HKEX Synapse will use smart contracts to streamline post-trade actions like share transfers and record-keeping for Stock Connect, which links the Hong Kong and China stock markets.

Automated settlement facilitated by the blockchain platform will reduce errors and delays compared to traditional paper-based processes. It also enhances transparency with immutable digital records.

The launch of HKEX Synapse slated for October 10 represents a major blockchain upgrade for managing Stock Connect’s intensive daily trading volumes across Hong Kong and Chinese equities.

Boosting International Participation

In a statement, HKEX Group Head of Emerging Business Glenda So said HKEX Synapse will “support the next phase of growth for international participation in Mainland China’s equity markets.”

Stock Connect has become increasingly popular with international investors since its 2014 inception, handling flows worth nearly HK$3 trillion in 2021.

By improving operational efficiency, HKEX Synapse is aimed at accommodating and encouraging greater overseas capital inflows into the mainland’s markets.

Interconnecting Blockchains and Databases

HKEX Synapse utilizes DAML, an open-source smart contract language that seamlessly integrates decentralized blockchains with traditional centralized databases.

This allows disparate systems to interoperate, a key benefit for bridging mainland Chinese and Hong Kong markets.

The launch highlights how strategic blockchain integrations by major stock exchanges like HKEX can drive post-trade innovation and attract foreign investor participation.