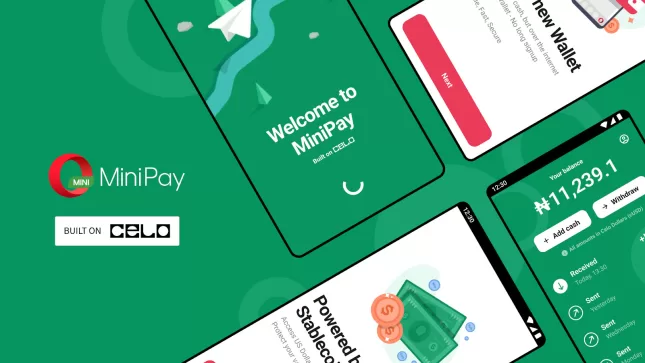

Opera, the renowned web browser, has ushered in a new era of digital payments in Africa with the introduction of MiniPay, a blockchain-based digital wallet. This innovative wallet is seamlessly integrated into the Opera Mini web browser and is built on the robust foundation of the Celo blockchain.

Simplified Digital Payments with MiniPay

MiniPay is meticulously designed to simplify and reduce the cost of digital transactions for people across Africa. It enables users to effortlessly access, send, or receive stablecoins, digital currencies known for their consistent and stable value. Remarkably, these transactions can be executed with just mobile phone numbers, streamlining the payment process for users.

Opera is harnessing the capabilities of Celo’s mobile-friendly blockchain system to deliver a user-friendly and efficient wallet for everyday individuals. The initial focus of MiniPay is to facilitate seamless and rapid stablecoin payments among users.

User-Friendly Features

One of the standout features of MiniPay is its user-friendly approach. Users can effortlessly connect their Google accounts during setup, making it straightforward to transfer digital assets and grasp the intricacies of blockchain transactions, even for those unfamiliar with cryptocurrencies. Additionally, MiniPay takes the initiative to securely store digital keys, automatically backing them up on Google Drive, ensuring users can easily recover their wallets if needed.

An Inclusive Financial Tool for Africa

MiniPay’s primary mission is to provide a fast, dependable, and inclusive financial solution for people in Africa. It is meticulously designed to seamlessly integrate with local payment methods, such as Airtime, MPesa, Bank Transfers, or Cards, through partnerships with local companies.

As a non-custodial wallet, MiniPay operates independently of traditional banks. Instead, it collaborates with local services to enable users to add or withdraw stablecoins in their local currency. Furthermore, MiniPay supports Celo’s FiatConnect standard, facilitating even easier stablecoin exchanges and enhancing the global Cash-In-Cash-Out experience.

With a history of operations spanning 17 years in Africa and over 100 million users on the continent, Opera is well-positioned to introduce MiniPay to the African market. The rollout of MiniPay will commence in the coming months, with Nigeria being the initial launch destination.

Jørgen Arnesen, the Executive Vice President for Mobile at Opera, emphasized the importance of MiniPay, stating, “Users in Nigeria, Kenya, Ghana, and South Africa have indicated that there are lingering concerns about high fees, unreliable service uptimes, a lack of transparency around transaction progress, and a lack of access to mobile data.” MiniPay seeks to address these concerns and usher in a new era of accessible and user-centric digital payments in Africa.