In the ever-evolving landscape of cryptocurrencies and digital assets, security and trust are paramount. BitGo, a notable player in the field, has risen to the occasion, offering robust custody solutions for institutional investors. In this article, we delve into the world of BitGo, exploring its origins, mission, and pivotal role in safeguarding digital wealth.

What is BitGo?

BitGo is a digital asset trust and security company that provides secure custody solutions for institutional investors. It was established in 2013 by Mike Belshe and Ben Davenport and has its headquarters in Palo Alto, California.

1. Exploring BitGo’s Custody Solutions: Security and Peace of Mind

In the fast-paced world of cryptocurrency, security is paramount. With digital assets worth millions at stake, investors and businesses alike seek reliable custody solutions to safeguard their holdings. BitGo, a trusted name in the crypto space, steps in to provide a range of custody options that offer both security and peace of mind. In this article, we’ll delve into BitGo’s custody services, including multi-signature wallets, cold storage, and insurance coverage, to understand how they help protect your valuable digital assets.

- Multi-signature wallets: These wallets require multiple keys to be used in order to authorize a transaction, which helps to prevent unauthorized access.

- Cold storage: This involves storing the keys to digital assets offline, which makes them less vulnerable to attack.

- Insurance: BitGo offers insurance coverage for its clients’ assets, up to $250 million.

The Evolution of Cryptocurrency Custody

1. Understanding the Need for Custody

Before we dive into BitGo’s offerings, it’s crucial to comprehend why custody solutions are vital in the world of cryptocurrency. Unlike traditional banks, where physical security measures are the norm, cryptocurrencies exist purely in the digital realm. This digital nature makes them susceptible to a unique set of risks, including hacking, fraud, and unauthorized access. Custody solutions address these vulnerabilities head-on.

2. BitGo: A Trusted Custodian

BitGo has earned its reputation as a trustworthy custodian in the crypto industry. With a commitment to security and innovation, BitGo has become a go-to choice for individuals and institutions seeking robust storage solutions.

Exploring BitGo’s Custody Options

1. Multi-Signature Wallets

BitGo offers multi-signature wallets, a sophisticated security feature that requires multiple keys to authorize a transaction. This additional layer of security significantly reduces the risk of unauthorized access or malicious activity. It’s akin to requiring multiple signatures to access a vault, ensuring that no single party can compromise your assets.

2. Cold Storage: Enhancing Security

One of the most effective methods of safeguarding digital assets is through cold storage. BitGo understands the importance of keeping keys offline to protect against online threats. By storing keys in an offline environment, often referred to as cold storage, BitGo minimizes the risk of hacks or breaches. This level of security is akin to locking your assets in a vault and removing them from the digital battlefield.

3. Peace of Mind with Insurance

BitGo goes the extra mile to provide peace of mind to its clients. They offer insurance coverage for digital assets held in their custody, with coverage extending up to an impressive $250 million. This insurance acts as a safety net, offering financial protection in the unlikely event of a security breach or loss.

Securing Your Crypto Holdings

In the ever-evolving landscape of cryptocurrency, security is non-negotiable. BitGo’s custody solutions, including multi-signature wallets, cold storage, and substantial insurance coverage, offer a comprehensive approach to safeguarding your digital assets. With BitGo as your custodian, you can navigate the crypto world with confidence, knowing that your investments are protected by state-of-the-art security measures.

2. Exploring BitGo’s Diverse Offerings: Beyond Custody

When it comes to navigating the intricate world of cryptocurrencies, having a reliable partner is essential. BitGo, a prominent name in the blockchain industry, not only excels in custody services but also extends its reach to provide an array of additional services. In this comprehensive article, we will explore the diverse offerings of BitGo, including trading, lending, DeFi access, and NFT wallet solutions, all designed to empower clients in their crypto journey.

Additional services provided by BitGo include:

- Trading: BitGo provides its clients with access to a variety of trading platforms.

- Lending: BitGo allows its clients to lend their digital assets to other investors.

- DeFi: BitGo provides its clients with access to DeFi applications.

- NFT wallets: BitGo allows its clients to store and manage NFTs.

Understanding BitGo’s Expanded Services

1. BitGo Trading Services

At BitGo, the commitment to offering a complete crypto solution is evident in its trading services. Clients can access a variety of trading platforms, facilitating the buying and selling of digital assets with ease. Whether you’re a seasoned trader or a newcomer to the crypto space, BitGo’s trading services provide the flexibility and tools needed to navigate the markets effectively.

2. Lending Your Digital Assets

BitGo goes a step further by allowing clients to lend their digital assets to other investors. This service opens up opportunities for clients to earn passive income from their crypto holdings. By participating in lending, clients can put their idle assets to work and potentially benefit from interest payments.

3. Unlocking DeFi with BitGo

Decentralized Finance, or DeFi, has been a game-changer in the blockchain space, offering innovative financial solutions. BitGo ensures its clients don’t miss out on this revolution by providing access to a range of DeFi applications. Clients can explore decentralized lending, yield farming, and liquidity provision, among other opportunities, all within the BitGo ecosystem.

4. NFT Wallet Solutions

The rise of Non-Fungible Tokens (NFTs) has captured the attention of artists, collectors, and investors alike. BitGo recognizes the importance of securely managing these unique digital assets and offers NFT wallet solutions. Clients can safely store, manage, and trade NFTs, ensuring that their prized digital collectibles remain protected.

BitGo: A Holistic Crypto Partner

BitGo’s expansion into these additional services reinforces its position as a holistic crypto partner. Beyond providing top-tier custody solutions, BitGo empowers its clients to take advantage of the full spectrum of opportunities in the crypto space.

Whether you’re a trader looking for diverse trading options, an investor interested in earning through lending, a DeFi enthusiast seeking access to innovative protocols, or an NFT aficionado in need of a secure wallet, BitGo has you covered.

Unleash the Potential of Your Crypto Holdings

In conclusion, BitGo’s commitment to offering a comprehensive suite of services sets it apart in the blockchain industry. With a robust foundation in custody services and a forward-looking approach to trading, lending, DeFi, and NFTs, BitGo is a versatile partner for crypto enthusiasts and investors.

As you explore the ever-evolving world of cryptocurrencies, consider BitGo as your trusted ally, helping you unlock the full potential of your digital assets.

3. BitGo: Safeguarding Digital Assets with Trust and Security

In an era dominated by digital innovations, safeguarding your digital assets is paramount. This is where BitGo steps in, offering institutional investors a secure and regulated solution for digital asset custody. Let’s dive into the world of BitGo and explore its key features and benefits.

Understanding BitGo

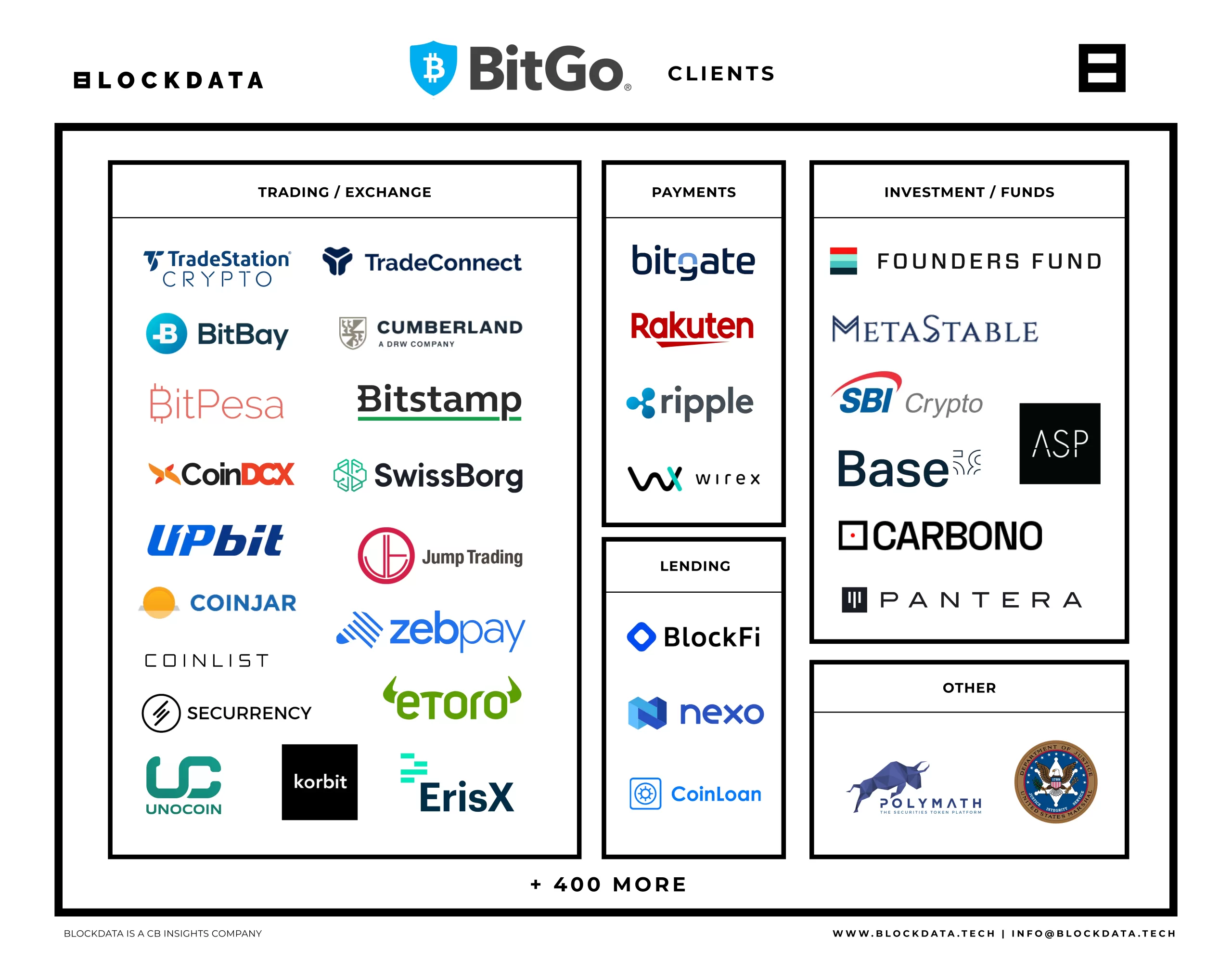

BitGo has established itself as a trusted provider of digital asset custody solutions, serving a diverse clientele that includes exchanges, hedge funds, and family offices. What sets BitGo apart is its status as a regulated custodian, adhering to rigorous security and compliance standards.

Key Features

Let’s take a closer look at the key features that make BitGo a standout choice for institutional investors seeking secure storage solutions for their digital assets:

1. Security First

BitGo places security at the forefront of its operations. It employs a range of advanced security measures, including:

- Multi-signature wallets: BitGo utilizes multi-signature wallets, requiring multiple keys to authorize transactions. This adds an additional layer of protection against unauthorized access.

- Cold Storage: Digital assets are stored offline in cold storage, minimizing vulnerability to online threats.

- Insurance: BitGo offers insurance coverage, providing clients with added peace of mind. With coverage extending up to $250 million, your assets are well-protected.

2. Scalability

BitGo is engineered to handle a significant volume of clients and transactions. Whether you are a small family office or a large exchange, BitGo’s infrastructure can accommodate your needs seamlessly.

3. Regulation Matters

BitGo’s status as a regulated custodian is a pivotal advantage. It adheres to industry regulations, ensuring that your assets are stored and managed in full compliance with established security and compliance standards.

4. Proven Experience

BitGo’s journey began in 2013, making it one of the pioneers in the digital asset custody industry. With a decade of experience, BitGo boasts a stellar track record of providing top-tier security solutions.

For institutional investors seeking a secure and dependable solution to safeguard their digital assets, BitGo emerges as a compelling choice. Rest assured, your assets will be in capable hands, fortified by BitGo’s unwavering commitment to security and compliance.

BitGo Milestone: A Journey of Excellence in Digital Asset Custody

When it comes to navigating the intricate world of cryptocurrencies, having a reliable partner is essential. BitGo, a prominent name in the blockchain industry, not only excels in custody services but also extends its reach to provide an array of additional services. In this comprehensive article, we will explore the diverse offerings of BitGo, including trading, lending, DeFi access, and NFT wallet solutions, all designed to empower clients in their crypto journey.

Unveiling BitGo’s Remarkable Milestones

1. December 2020: Reaching $16 Billion in Assets Under Custody (AUC)

BitGo’s journey towards excellence began with a significant milestone: reaching $16 billion in AUC. This achievement underscored the trust that investors and institutions place in BitGo’s custody solutions.

2. November 2021: Surpassing $64 Billion in AUC

BitGo’s growth knew no bounds, as it surpassed the $64 billion mark in AUC in November 2021. This remarkable growth showcased BitGo’s ability to scale and adapt to the ever-expanding world of cryptocurrencies.

3. 20% of All On-Chain Bitcoin Transactions

BitGo became synonymous with Bitcoin transactions, processing an astounding 20% of all on-chain Bitcoin transactions by value each month. This volume highlighted BitGo’s pivotal role in facilitating the movement of digital assets.

4. Securing Assets for Over 100 Million Users

BitGo’s reach extended far and wide, securing assets for over 100 million users. This impressive user base emphasized BitGo’s reputation as a trusted custodian among individuals and institutions alike.

5. Powering 150+ Crypto Exchanges Worldwide

BitGo’s influence reverberated across the globe, powering more than 150 crypto exchanges. Their technology underpinned the trading activities of countless users and businesses.

6. World’s Sole Custodian for WBTC (Wrapped Bitcoin)

BitGo’s significance was further cemented as the world’s sole custodian for WBTC, a testament to their role in the broader crypto ecosystem.

7. Qualified Custodian Across Multiple Jurisdictions

BitGo blazed a trail by becoming the first qualified custodian for storing digital assets in New York, Switzerland, and Germany. Their commitment to compliance and security set a new standard in the industry.

8. Achieving SOC 2 Type 2 Compliance

SOC 2 Type 2 compliance is no small feat, and BitGo attained it with distinction. This certification emphasized their unwavering commitment to security and data protection.

9. Introducing TRUST – The Travel Rule Universal Solution Technology

BitGo’s commitment to innovation shone through with the introduction of TRUST, a solution addressing the Travel Rule, a critical regulatory requirement in the crypto world.

Beyond Milestones: A Glimpse into BitGo’s Journey

BitGo’s journey is not just defined by milestones but also by significant events that shaped its path:

- Foundation in 2013: BitGo was founded by visionaries Mike Belshe and Ben Peters in 2013, setting the stage for its remarkable journey.

- Pioneering Multi-Signature Wallets: BitGo made history by offering the first multi-signature wallets for Bitcoin, enhancing security in the digital asset space.

- BitGo Trust Launch in 2018: BitGo Trust was launched as the first qualified custodian for storing digital assets, a pioneering move in the industry.

- Acquisition of AZA in 2020: In 2020, BitGo acquired AZA, a leading provider of digital asset trading and custody solutions, further expanding its capabilities.

- Securing $100 Million in 2021: In 2021, BitGo raised a substantial $100 million in funding from esteemed investors like Galaxy Digital and Goldman Sachs.

- Series C Funding in 2023: In a testament to its continued success, BitGo raised another $100 million in Series C funding in 2023, achieving a remarkable valuation of $1.75 billion.

BitGo: A Custodian of Excellence

BitGo’s journey is one of excellence and dedication. As a leading player in the digital asset custody space, BitGo has consistently demonstrated its commitment to security, compliance, and innovation. Its milestones reflect not only its success but also the growing acceptance of cryptocurrencies by institutional investors and enterprises.

BitGo’s story is far from over; it’s a journey of continuous growth and evolution. As the cryptocurrency landscape continues to transform, BitGo stands poised to lead the way, ensuring the security and success of its clients in the years to come.

Exploring Similar Technologies to BitGo: Your Guide to Digital Asset Solutions

In the ever-evolving landscape of digital assets, security and reliability are paramount. BitGo, a prominent name in the industry, has established itself as a go-to provider of digital asset financial services, offering institutional investors liquidity, custody, and top-tier security solutions. However, it’s essential to be aware of alternative technologies that cater to similar needs. In this article, we will delve into several technologies akin to BitGo, providing a comprehensive overview of their offerings.

The Digital Asset Landscape

Digital assets have garnered immense attention from institutional investors and individuals alike. They encompass a wide range of assets, including cryptocurrencies, tokenized securities, and more. The need for secure storage, management, and efficient transactions of these assets has led to the emergence of specialized solutions.

BitGo: A Glimpse

Before we explore BitGo’s counterparts, let’s briefly touch upon BitGo’s distinguishing features:

- Hot and Cold Wallets: BitGo offers both hot wallets (online) and cold wallets (offline) for the storage of digital assets, catering to varying security needs.

- Multi-Signature Wallets: Multi-signature wallets enhance security by requiring multiple authorizations for transactions.

- Insurance Coverage: BitGo provides insurance coverage of up to $250 million, bolstering investor confidence.

- Regulation and Compliance: BitGo operates within regulatory frameworks, ensuring adherence to legal requirements.

- Customer Support: With round-the-clock customer support, BitGo offers assistance whenever needed.

- Competitive Pricing: BitGo’s pricing is competitive, making it accessible to a wide range of investors.

Exploring Similar Technologies

Now, let’s delve into technologies akin to BitGo:

1. Fireblocks

Fireblocks stands out as a blockchain security platform offering a suite of products designed to safeguard digital assets. These include hot wallets, cold wallets, and institutional-grade encryption. Fireblocks focuses on delivering top-notch security solutions to meet the needs of institutional investors.

2. Copper

Copper specializes in digital asset custody, providing a secure and compliant way to store and manage digital assets. With a robust emphasis on compliance, Copper offers peace of mind to investors seeking regulatory adherence.

3. Anchorage Digital

Anchorage Digital serves as a digital asset bank, offering custody, trading, and lending services tailored for institutional investors. Anchorage Digital’s comprehensive approach makes it a valuable player in the digital asset ecosystem.

4. Gemini Custody

Gemini Custody operates as a regulated digital asset custodian, providing a secure and compliant environment for storing and managing digital assets. Gemini’s commitment to regulatory standards is a hallmark of its services.

5. Metaco

Metaco specializes in digital asset security, offering a suite of protective products that include hardware wallets, software wallets, and multi-signature wallets. Metaco focuses on enhancing the security of digital assets through innovative solutions.

A Comparative Overview

To aid in your decision-making process, here’s a table comparing the key features of BitGo and its counterparts:

| Feature | BitGo | Fireblocks | Copper | Anchorage Digital | Gemini Custody | Metaco |

|---|---|---|---|---|---|---|

| Hot wallets | Yes | Yes | Yes | Yes | Yes | Yes |

| Cold wallets | Yes | Yes | Yes | Yes | Yes | Yes |

| Multi-signature wallets | Yes | Yes | Yes | Yes | Yes | Yes |

| Insurance | Up to $250 million | Up to $100 million | Up to $100 million | Up to $250 million | Up to $200 million | Up to $100 million |

| Regulation | Yes | Yes | Yes | Yes | Yes | Yes |

| Compliance | Yes | Yes | Yes | Yes | Yes | Yes |

| Customer support | 24/7 | 24/7 | 24/7 | 24/7 | 24/7 | 24/7 |

| Pricing | Competitive | Competitive | Competitive | Competitive | Competitive | Competitive |

Choosing the Right Solution

The selection of a digital asset custody solution should align with your specific needs and requirements. Consider factors such as security, compliance, customer support, and pricing. A thorough evaluation of these elements will guide you toward the most suitable choice for your digital asset management.

As the digital asset landscape continues to evolve, the importance of reliable custody solutions cannot be overstated. Whether you opt for BitGo or one of its counterparts, rest assured that each of these technologies plays a pivotal role in the secure and efficient management of digital assets.

BitGo’s Revenue Prediction

The cryptocurrency landscape has been nothing short of dynamic, with institutions increasingly venturing into the realm of digital assets. Amidst this transformative wave, BitGo has emerged as a key player, offering secure and reliable custody solutions. In this article, we explore BitGo’s revenue prediction for 2023 and beyond, shedding light on the factors propelling its growth.

Understanding BitGo’s Revenue

BitGo, a prominent name in the digital asset custody sector, has been on a growth trajectory. To comprehend its revenue prediction, we need to consider several key factors:

1. Estimated Revenue per Employee

BitGo’s revenue per employee is a significant indicator of its financial performance. As of the latest data, the company generates an estimated $178,000 in revenue per employee.

2. Workforce Strength

BitGo boasts a dedicated team of 150 employees, each contributing to the company’s revenue generation efforts.

3. Annual Revenue for 2023

Based on the revenue per employee and the workforce size, BitGo’s annual revenue for 2023 is estimated to reach an impressive $97.9 million.

A Historical Perspective

To gain further insights, let’s take a glance at BitGo’s revenue history over the past few years:

- 2021: BitGo’s revenue reached $60 million, signifying its growth potential within the digital asset custody sector.

- 2022: The company continued its upward trajectory, with revenue hitting $80 million.

- 2023 (Estimated): BitGo’s projected revenue for 2023 stands at $97.9 million, showcasing substantial growth.

- 2024 (Projected): Looking ahead, BitGo’s revenue is projected to rise to $125 million, indicative of its strong positioning in the market.

The Driving Force: Institutional Adoption

BitGo’s impressive revenue growth can be attributed to the escalating interest in cryptocurrencies among institutional investors. As institutions recognize the potential of digital assets as an investment class, the need for secure custody solutions has become paramount. BitGo, with its robust security measures and compliance standards, is well-equipped to cater to this demand.

A Promising Future

BitGo’s revenue prediction for 2023 paints a picture of sustained growth within the cryptocurrency custody sector. As the adoption of digital assets continues to expand, BitGo’s position as a trusted custodian is solidified. The projected revenue of $97.9 million for 2023 and the anticipated $125 million for 2024 underscore BitGo’s potential to thrive in the evolving cryptocurrency landscape.

In conclusion, BitGo’s revenue prediction reflects not only its own success but also the broader trend of institutional engagement with cryptocurrencies. As the digital asset market matures, BitGo remains at the forefront, ensuring the security and integrity of digital assets for its clients.

BitGo Founder Mike Belshe and Ben Davenport

Mike Belshe and Ben Davenport are the co-founders of BitGo, a digital asset trust company and security company headquartered in Palo Alto, California. They founded the company in 2013 with the goal of providing secure storage for Bitcoin and other cryptocurrencies.

Mike Belshe is a serial entrepreneur with over 20 years of experience in the technology industry. He previously worked at Google and Microsoft, where he developed security software for enterprise customers. He is also the co-founder of the Bitcoin Foundation, a non-profit organization that promotes the use of Bitcoin.

Ben Davenport is a software engineer with over 10 years of experience in the financial technology industry. He previously worked at Facebook, where he developed the Messenger app. He is also a co-founder of the Beluga startup, which was acquired by Facebook in 2014.

Together, Mike Belshe and Ben Davenport have built BitGo into one of the leading providers of digital asset security solutions. The company’s products and services are used by financial institutions, exchanges, and other businesses to store and manage their cryptocurrency assets.

In 2021, Galaxy Digital announced its acquisition of BitGo for $1.2 billion. However, the acquisition was later canceled due to the crypto downturn. BitGo remains an independent company today and is one of the most trusted names in the digital asset security industry.

Here are some of the key achievements of Mike Belshe and Ben Davenport at BitGo:

- Pioneered the multi-signature wallet, which is now a standard security practice in the cryptocurrency industry.

- Built TSS (Threshold Signature Scheme), a more advanced multi-signature technology that is used by BitGo’s institutional clients.

- Developed a variety of other security products and services, including cold storage, hot wallet management, and fraud detection.

- Grown BitGo into a leading provider of digital asset security solutions, with over $10 billion in assets under management.

Mike Belshe and Ben Davenport are both respected leaders in the cryptocurrency industry. They have helped to make BitGo one of the most trusted names in digital asset security. Their work has helped to promote the adoption of cryptocurrencies and made them more secure for businesses and individuals.

In conclusion, BitGo stands as a formidable force in the realm of digital asset trust and security. Its journey from inception to its current position as a trusted custodian is marked by innovation, commitment, and a relentless pursuit of excellence.